File Info

| Exam | ACI Dealing Certificate |

| Number | 3I0-012 |

| File Name | ACI.3I0-012.PracticeTest.2018-05-25.440q.vcex |

| Size | 1 MB |

| Posted | May 25, 2018 |

| Download | ACI.3I0-012.PracticeTest.2018-05-25.440q.vcex |

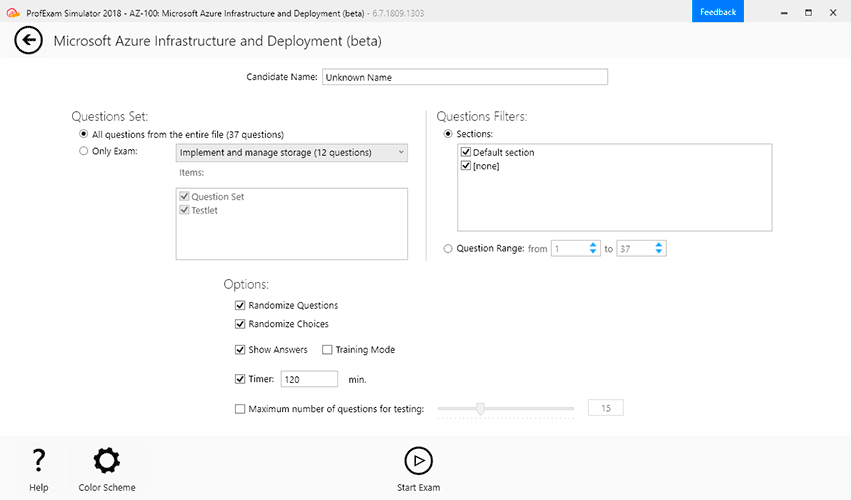

How to open VCEX & EXAM Files?

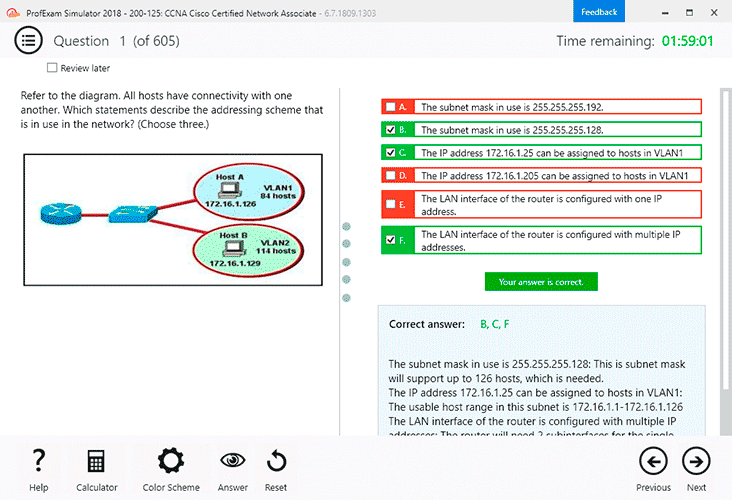

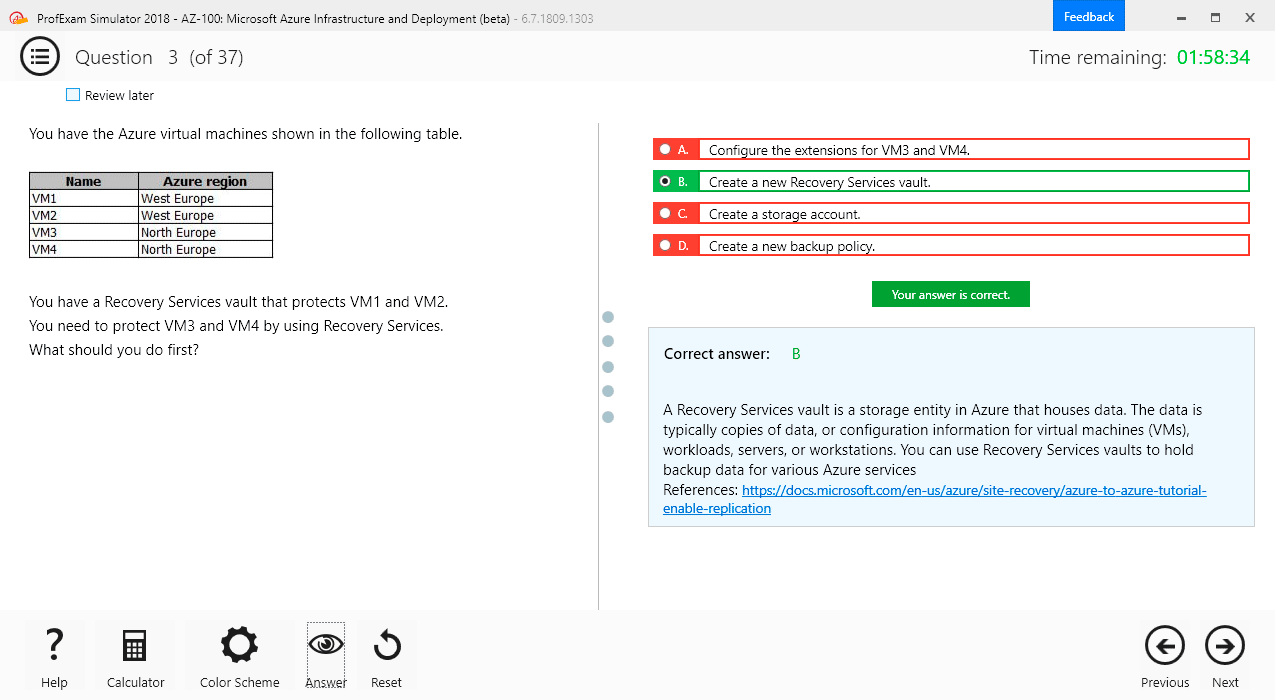

Files with VCEX & EXAM extensions can be opened by ProfExam Simulator.

Coupon: MASTEREXAM

With discount: 20%

Demo Questions

Question 1

An option contract that gives the buyer the right to exercise the option at several distinct points during its life is called:

- European-style option

- American-style option

- Bermudan option

- Asian option

Correct answer: C

Question 2

When considering interest rate risk in the banking book, retail demand deposits without fixed contractual maturity:

- should be assumed to have zero duration

- should be treated like other instantly variable rate liabilities, such as overnight money market borrowing.

- should be assumed to have a low correlation with money market reference rates

- represent a minor contributor to interest rate risk and can safely be disregarded

Correct answer: C

Question 3

If the duration gap is zero, how will a small parallel shift in interest rates affect the market value of the bank’s equity?

- If interest rates rise, the market value of equity will increase

- If interest rates rise, the market value of equity will decrease

- The bank is immunised from changes in interest rates.

- The market value of equity will decrease due to an increase in interest rates

Correct answer: C

Question 4

Which of the following statements is correct regarding duration?

- It is a measure of the average price of a financial instrument.

- It doesn’t take into account the timing and market value of cash flows.

- It increases if the average coupon increases.

- It decreases as maturity decreases

Correct answer: D

Question 5

Using reprising gap analysis, a bank’s balance sheet is considered liability-sensitive to market interest rate changes, if:

- more liabilities than assets will be reprised in the near term

- more assets than liabilities will be reprised in the near term

- more assets than liabilities have variable rates or short residual maturities

- non-interest bearing liabilities are greater than non-interest bearing assets

Correct answer: A

Question 6

Which of the following statements about the Liquidity Coverage Ratio is correct?

- The LCR is a measure to ensure that the reserve of high quality liquid assets is sufficient to cover short term demand for liquidity in a stress situation.

- the ratio (cash outflow in a 30-day stress period divided by high quality liquid assets) has to be greater than 100%.

- Covered bonds are class 1 assets.

- Obligations issued by central banks or government agencies are class 2 assets.

Correct answer: A

Question 7

Which one of the following statements about mark-to-model valuation is correct?

- Mark-to-model valuation is used for exchange-traded positions to ensure correct pricing.

- Asset managers are not allowed to use mark-to-model valuation.

- Mark-to-model valuation is used for complex financial instruments; it is always accurate and in line with potential tradable prices.

- Mark-to-model valuation refers to prices determined by financial models, rather than actual market prices.

Correct answer: D

Question 8

A closed position in a particular foreign currency exists:

- when the net spot position plus the forward position plus the delta equivalent of the foreign currency options book add up to zero

- when the forward purchases of a foreign currency are equivalent to the equity position in that same currency

- when the reverse repurchases of foreign currency are equal to the forward purchases of the functional currency

- when the maturity structure of the assets in one currency is closely matched to the maturity structure of liabilities in another

Correct answer: A

Question 9

Which of the following are all goals of the originator of securitized assets?

- to increase funding diversification , to reduce funding costs, to achieve regulatory and accounting benefits, to increase the size of the balance sheet

- to increase funding diversification , to reduce funding costs, to achieve regulatory and accounting benefits

- to increase funding diversification , to reduce operational risk, to achieve regulatory and accounting benefits, to decrease the size of the balance sheet

- to increase funding diversification , to reduce operational risk, to achieve regulatory and accounting benefits, to increase the size of the balance sheet

Correct answer: B

Question 10

Which of the following risks are considered market risks?

- interest rate, currency, equity and commodity risk

- interest rate, currency, equity and default risk

- interest rate, equity, liquidity and default risk

- legal, reputation and regulatory risk

Correct answer: A