File Info

| Exam | ACI Dealing Certificate |

| Number | 3I0-012 |

| File Name | ACI.3I0-012.PracticeTest.2018-07-12.444q.vcex |

| Size | 1 MB |

| Posted | Jul 12, 2018 |

| Download | ACI.3I0-012.PracticeTest.2018-07-12.444q.vcex |

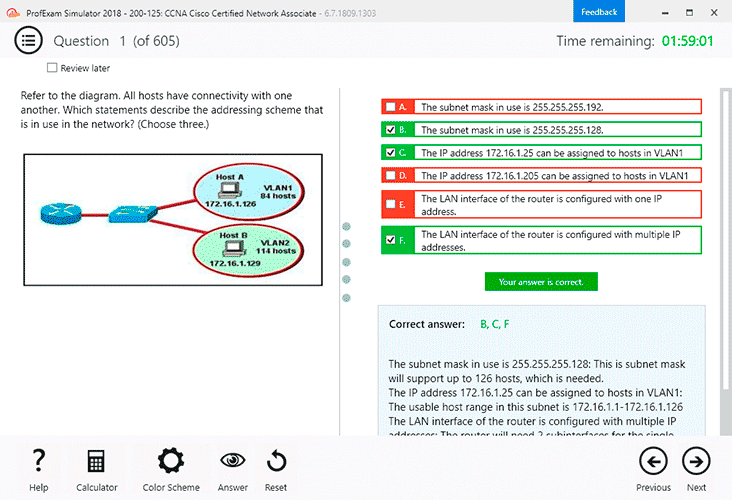

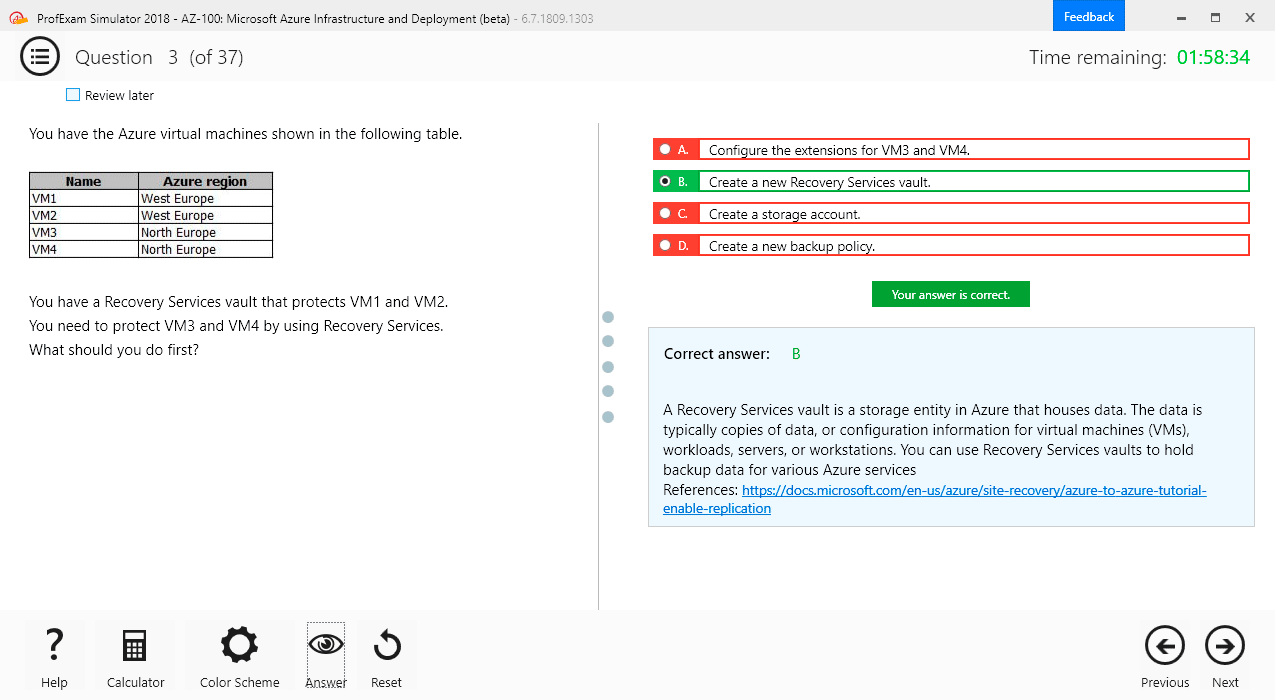

How to open VCEX & EXAM Files?

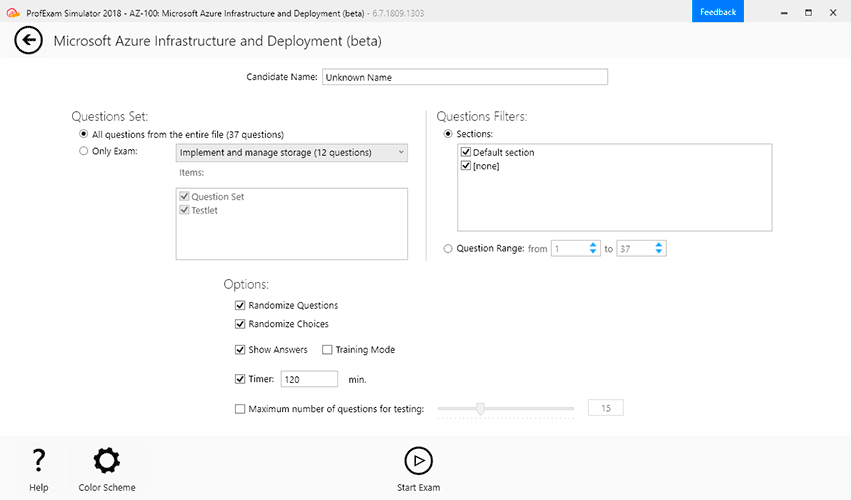

Files with VCEX & EXAM extensions can be opened by ProfExam Simulator.

Coupon: MASTEREXAM

With discount: 20%

Demo Questions

Question 1

You are quoted the following market rates:

spot USD/SEK 6.3850

1M (30-day) USD 0.40%

1M (30-day) SEK 1.15%

What is 1-month USD/SEK?

- 6.4250

- 6.3810

- 6.7850

- 6.3890

Correct answer: D

Question 2

You are quoted the following market rates:

Spot GBP/USD 1.5525

9M (272-day) GBP 0.81%

9M (272-day) USD 0.55%

What are the 9-month GBP/USD forward points?

- -30

- +29

- -29

- +30

Correct answer: C

Question 3

You quote a customer spot AUD/USD at 1.0350-55. The T/N swap is quoted to you at 3/2. The customer asks to buy USD for value tomorrow.

What rate should you quote him to break-even against the other rates?

- 1.0352

- 1.0353

- 1.0347

- 1.0348

Correct answer: A

Question 4

Which of the following is true about interest rate swaps (IRS):

- Both parties know what their future payments will be at the outset of the swap

- There is payment of principal at maturity

- Payments are always made gross

- The fixed rate payer knows what his future payments will be at the outset of the swap

Correct answer: D

Question 5

Which of the following is true?

- The 3-month Sterling (SHORT STERLING) futures contract has a basis point value of GBP 25.00 and a face value of GBP 1,000,000 .00

- The EUROYEN TIBOR futures contract has a basis point value of JPY 25,000 and a face value of JPY 1,000,000,000

- The CME EURODOLLAR futures contract has a minimum price interval of one-quarter basis point value (0.0025) for the nearest contract

- The 3-month EURIBOR futures contract has a minimum price interval of half a basis point value (0.0050) for the nearest contract

Correct answer: C

Question 6

EURODOLLAR futures are:

- Traded on the Chicago Mercantile Exchange (CME Group) and have a face value of USD 500,000.00

- Traded on the Intercontinental Exchange (ICE) and have a face value of USD 1,000,000.00

- Traded on the Intercontinental Exchange (ICE) and have a face value of USD 500,000.00

- Traded on the Chicago Mercantile Exchange (CME Group) and have a face value of USD 1,000,000.00

Correct answer: D

Question 7

You have a short position of 50 EURODOLLAR futures contracts. You can hedge your position by:

- Selling a FRA for a similar notional amount

- Buying a FRA for a similar notional amount

- Selling a call option on the contract

- Selling a put option on the contract

Correct answer: A

Question 8

If a dealer has a 6-month USD asset and a 3-month USD liability, how could he hedge his balance sheet exposure in the FRA market?

- Buy 3x6

- Sell 3x6

- Buy 0x6

- Sell 6x9

Correct answer: A

Question 9

What is the Overnight Index for EUR?

- EURIBOR

- EONIA

- EUREPO

- EURONIA

Correct answer: B

Question 10

You bought a CAD 8,000,000.00 6x9 FRA at 1.95%. The settlement rate is 3-month (90-day) BBA LIBOR, which is fixed at 0.9500%.

What is the settlement amount at maturity?

- You pay CAD 20,000.00

- You receive CAD 20,000.00

- You pay CAD 19,952.61

- You receive CAD 19,952.61

Correct answer: C