File Info

| Exam | CPA Auditing and Attestation Exam |

| Number | AUD |

| File Name | AICPA.AUD.ActualTests.2019-03-15.613q.tqb |

| Size | 5 MB |

| Posted | Mar 15, 2019 |

| Download | AICPA.AUD.ActualTests.2019-03-15.613q.tqb |

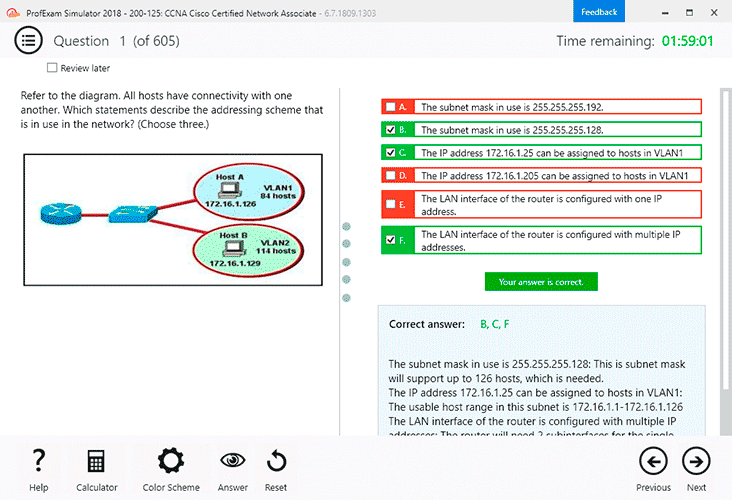

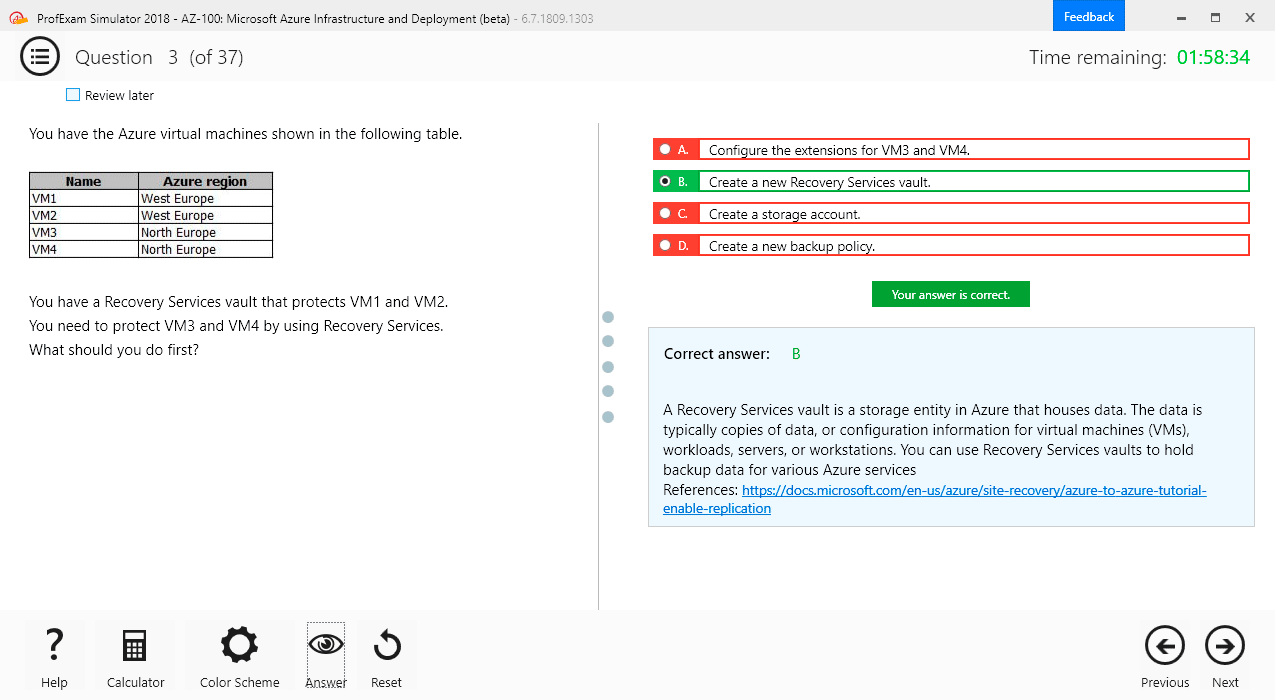

How to open VCEX & EXAM Files?

Files with VCEX & EXAM extensions can be opened by ProfExam Simulator.

Coupon: MASTEREXAM

With discount: 20%

Demo Questions

Question 1

Several sources of GAAP consulted by an auditor are in conflict as to the application of an accounting principle.

Which of the following should the auditor consider the most authoritative?

- FASB Technical Bulletins.

- AICPA Accounting Interpretations.

- FASB Statements of Financial Accounting Concepts.

- AICPA Technical Practice Aids.

Correct answer: A

Explanation:

Choice "A" is correct. In accordance with the GAAP hierarchy, FASB Technical Bulletins are considered the most authoritative of the sources listed in the question. Choice "B" is incorrect. Of the sources listed, AICPA Accounting Interpretations would be considered the second most authoritative. Choice "C" is incorrect. FASB Statements of Financial Accounting Concepts are among the least authoritative sources of GAAP available to auditors. Choice "D" is incorrect. AICPA Technical Practice Aids are among the least authoritative sources of GAAP available to auditors. Choice "A" is correct. In accordance with the GAAP hierarchy, FASB Technical Bulletins are considered the most authoritative of the sources listed in the question.

Choice "B" is incorrect. Of the sources listed, AICPA Accounting Interpretations would be considered the second most authoritative.

Choice "C" is incorrect. FASB Statements of Financial Accounting Concepts are among the least authoritative sources of GAAP available to auditors.

Choice "D" is incorrect. AICPA Technical Practice Aids are among the least authoritative sources of GAAP available to auditors.

Question 2

For an entity's financial statements to be presented fairly in conformity with generally accepted accounting principles, the principles selected should:

- Be applied on a basis consistent with those followed in the prior year.

- Be approved by the Auditing Standards Board or the appropriate industry subcommittee.

- Reflect transactions in a manner that presents the financial statements within a range of acceptable limits.

- Match the principles used by most other entities within the entity's particular industry.

Correct answer: C

Explanation:

Choice "C" is correct. Financial statements are presented fairly in conformity with GAAP when there are no material misstatements included therein. The fact that there may occasionally be immaterial misstatements means that the financial statements are correct "within a range of acceptable limits." Choice "A" is incorrect. Accounting principles may change from year to year. As long as such changes are properly accounted for, the financial statements are still in conformity with GAAP. Choice "B" is incorrect. The AICPA and the FASB determine GAAP, not the Auditing Standards Board. Choice "D" is incorrect. There is no requirement that an entity's financial statements be prepared in accordance with prevalent industry practices in order to be in conformity with GAAP Choice "C" is correct. Financial statements are presented fairly in conformity with GAAP when there are no material misstatements included therein. The fact that there may occasionally be immaterial misstatements means that the financial statements are correct "within a range of acceptable limits."

Choice "A" is incorrect. Accounting principles may change from year to year. As long as such changes are properly accounted for, the financial statements are still in conformity with GAAP.

Choice "B" is incorrect. The AICPA and the FASB determine GAAP, not the Auditing Standards Board.

Choice "D" is incorrect. There is no requirement that an entity's financial statements be prepared in accordance with prevalent industry practices in order to be in conformity with GAAP

Question 3

Which of the following statements is correct concerning an auditor's responsibilities regarding financial statements?

- An auditor may not draft an entity's financial statements based on information from management's accounting system.

- The adoption of sound accounting policies is an implicit part of an auditor's responsibilities.

- An auditor's responsibilities for audited financial statements are confined to the expression of the auditor's opinion.

- Making suggestions that are adopted about an entity's internal control environment impairs an auditor's independence.

Correct answer: C

Explanation:

Choice "C" is correct. An auditor's responsibility is to express an opinion on financial statements based on an audit. Choice "A" is incorrect. An auditor may draft an entity's financial statements based on information from management's financial system. This would be referred to as a compilation engagement. Choice "B" is incorrect. The adoption of sound accounting policies is an implicit part of management's responsibilities, not the auditor's responsibilities. Choice "D" is incorrect. An auditor often makes suggestions that are adopted about an entity's internal control environment. Choice "C" is correct. An auditor's responsibility is to express an opinion on financial statements based on an audit.

Choice "A" is incorrect. An auditor may draft an entity's financial statements based on information from management's financial system. This would be referred to as a compilation engagement.

Choice "B" is incorrect. The adoption of sound accounting policies is an implicit part of management's responsibilities, not the auditor's responsibilities.

Choice "D" is incorrect. An auditor often makes suggestions that are adopted about an entity's internal control environment.