File Info

| Exam | CERTIFIED REGULATORY COMPLIANCE MANAGER |

| Number | CRCM |

| File Name | Banking.CRCM.CertKey.2018-12-08.260q.tqb |

| Size | 983 KB |

| Posted | Dec 08, 2018 |

| Download | Banking.CRCM.CertKey.2018-12-08.260q.tqb |

How to open VCEX & EXAM Files?

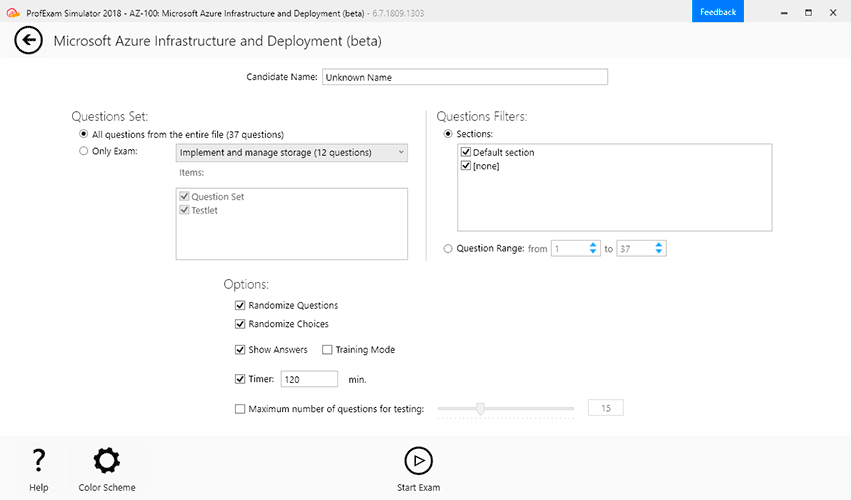

Files with VCEX & EXAM extensions can be opened by ProfExam Simulator.

Coupon: MASTEREXAM

With discount: 20%

Demo Questions

Question 1

Compliance issues related to payday lending are all of the following EXCEPT:

- Payday lending may adversely affect a bank’s CRA rating. Any illegal or questionable practices will negatively affect a bank’s CRA performance. A payday lending program may be inconsistent with helping to meet the community’s credit needs

- The bank (or its third-party partner) must properly disclose all finance charges and fees to payday lending customers. Advertisements of the program are also subject to Truth-in-Lending requirements

- Adverse action disclosures must be provided to applicants of payday loans that are denied if a consumer report (including check tracking services) was used in the credit decision

- The bank may be subject to the FOC’s unfair or deceptive practices rules.

Correct answer: D

Question 2

Which of the following comes under the heading of nontraditional mortgage product risks?

- Reduced documentation adds risk to a mortgage loan. Institutions may rely on reduced documentation in the credit underwriting process. Income and credit verification may not be obtained. Use of reduced documentation should be subject to clear policies that require more documentation when the credit risk rises

- Reduced documentation adds risk to a mortgage loan. Institutions may rely on reduced documentation in the credit underwriting process. Income and credit verification may not be obtained. Use of reduced documentation should be subject to clear policies that require more documentation when the credit risk rises

- Perform due diligence before entering into third-party relationships, including a review of the third party’sGeneral competenceBusiness practices and operationsReputationFinancial capacityInternal controlsRecord of compliance with laws

- Amounts credited as recovery on a loan must not exceed all principal, finance charges, and fees previously charged off. Amounts that exceed these must be credited as income

Correct answer: AB

Question 3

In Guidance on Nontraditional Mortgage Product Risks, if the institution has a concentration in a nontraditional mortgage portfolio, the institution should:

- Have well-developed monitoring systems and risk management practices

- Monitor by originator and key borrower and portfolio characteristics

- Not understand the risk of payment shock and negative amortization

- A and B

Correct answer: D