File Info

| Exam | CERTIFIED REGULATORY COMPLIANCE MANAGER |

| Number | CRCM |

| File Name | Banking.CRCM.CertKey.2018-12-08.260q.vcex |

| Size | 208 KB |

| Posted | Dec 08, 2018 |

| Download | Banking.CRCM.CertKey.2018-12-08.260q.vcex |

How to open VCEX & EXAM Files?

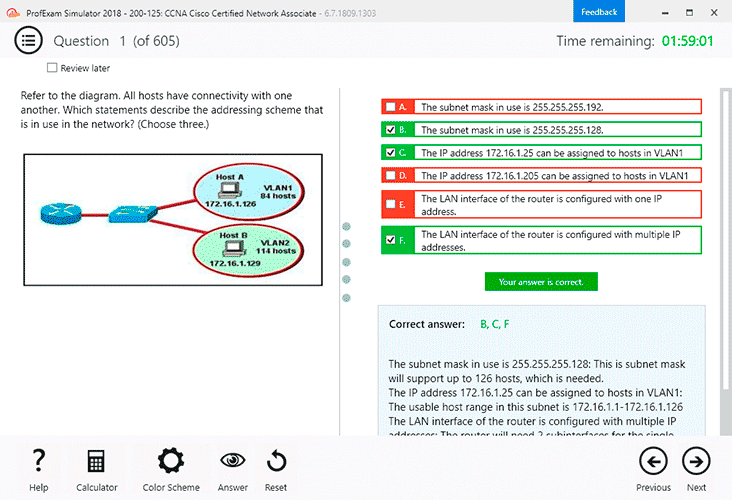

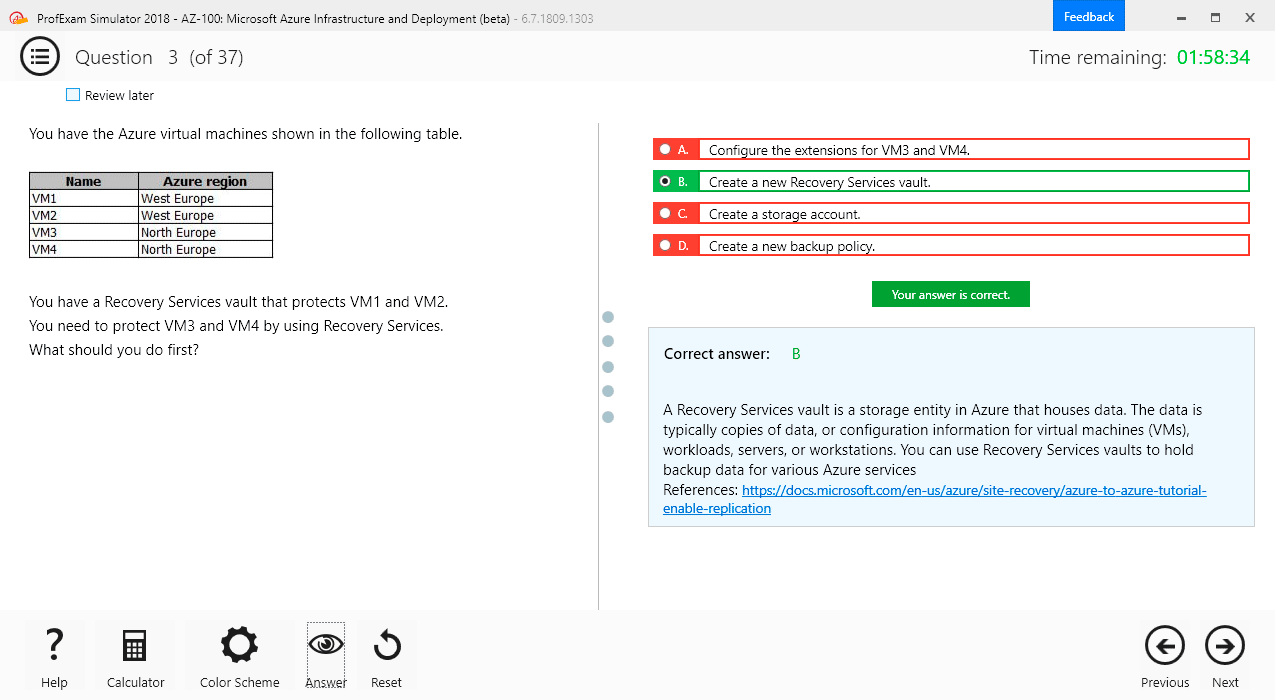

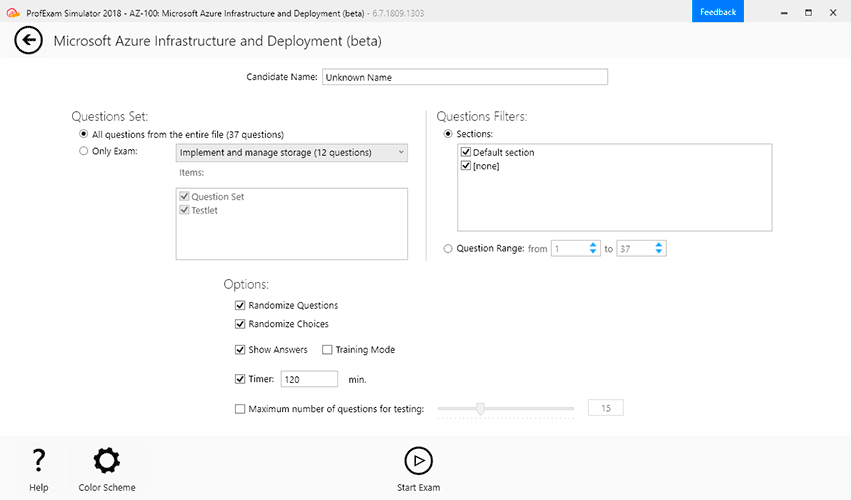

Files with VCEX & EXAM extensions can be opened by ProfExam Simulator.

Coupon: MASTEREXAM

With discount: 20%

Demo Questions

Question 1

Compliance issues related to payday lending are all of the following EXCEPT:

- Payday lending may adversely affect a bank’s CRA rating. Any illegal or questionable practices will negatively affect a bank’s CRA performance. A payday lending program may be inconsistent with helping to meet the community’s credit needs

- The bank (or its third-party partner) must properly disclose all finance charges and fees to payday lending customers. Advertisements of the program are also subject to Truth-in-Lending requirements

- Adverse action disclosures must be provided to applicants of payday loans that are denied if a consumer report (including check tracking services) was used in the credit decision

- The bank may be subject to the FOC’s unfair or deceptive practices rules.

Correct answer: D

Question 2

Which of the following comes under the heading of nontraditional mortgage product risks?

- Reduced documentation adds risk to a mortgage loan. Institutions may rely on reduced documentation in the credit underwriting process. Income and credit verification may not be obtained. Use of reduced documentation should be subject to clear policies that require more documentation when the credit risk rises

- Reduced documentation adds risk to a mortgage loan. Institutions may rely on reduced documentation in the credit underwriting process. Income and credit verification may not be obtained. Use of reduced documentation should be subject to clear policies that require more documentation when the credit risk rises

- Perform due diligence before entering into third-party relationships, including a review of the third party’sGeneral competenceBusiness practices and operationsReputationFinancial capacityInternal controlsRecord of compliance with laws

- Amounts credited as recovery on a loan must not exceed all principal, finance charges, and fees previously charged off. Amounts that exceed these must be credited as income

Correct answer: AB

Question 3

In Guidance on Nontraditional Mortgage Product Risks, if the institution has a concentration in a nontraditional mortgage portfolio, the institution should:

- Have well-developed monitoring systems and risk management practices

- Monitor by originator and key borrower and portfolio characteristics

- Not understand the risk of payment shock and negative amortization

- A and B

Correct answer: D

Question 4

If the institution offers both full and reduced documentation loans and there is a pricing premium attached to the reduced documentation loan, the consumer should:

- Be alerted to this fact

- Not be alerted to this fact

- Provide consumers with a clear statement of the options available

- Not lead consumers with payment option ARMs to choose a non-amortizing or negatively amortizing payment

Correct answer: A

Explanation:

Question 5

Institutions that offer nontraditional mortgage products should make sure they comply with the following, as applicable, EXCEPT:

- Truth in Lending Act

- FTC Act (i.e., Unfair and Deceptive Acts and Practices)

- RESTA

- State laws prohibiting deceptive trade practices

Correct answer: C

Question 6

Underwriting standards in Subprime Mortgage Lending include:

- The borrower’s debt-to-income ratio should include the borrower’s total yearly housing-related payments as a percentage of gross monthly income

- Institutions should have a clear policy governing the use of risk-layering features, such as reduced documentation loans or simultaneous second lien mortgages

- Stated income and reduced documentation loans to subprime borrowers should be made only if there are clear, documented mitigating factors

- Mitigating factors should be present when risk layering features are combined in order to support the underwriting decision and the borrower’s repayment capacity

Correct answer: A

Question 7

Below mentioned is the necessary information that should be included in the ___________. Risk of payment shock—potential payment increases; how the new payment will be calculated when the introductory rate expires Ramifications of prepayment penalties—how they will be calculated, when they will be imposed Ramifications of balloon payments Ramifications of the lack of escrowing for taxes and insurance—who is responsible for paying taxes and insurance and the fact that their costs may be substantial Cost of reduced documentation loans—whether there is a pricing premium required

- Consumer protection principles

- Underwriting standards

- Workout arrangements

- None of these

Correct answer: A

Question 8

Supervisory review should also be the part of Subprime Mortgage Lending. It should review:

- Regulatory agencies will continue to focus on risk management review and consumer compliance processes

- Hiring and Training of personnel

- Agencies will continue to take action against institutions that violate consumer protection laws or fair lending laws or that engages in unfair or deceptive acts or practices or in unsafe or unsound lending practices

- Applicability of prepayment penalties

Correct answer: AC

Question 9

The act limited balloon payments in consumer leases and enabled consumers to compare lease terms with credit terms where appropriate. The act was implemented by Regulation M (Consumer Leasing). It requires disclosures to consumers before consummation of the lease agreement. This act is:

- Consumer leasing act

- Risk disclosure act

- ALLL

- None of these

Correct answer: A

Question 10

Content of segregated disclosures in Consumer Leasing Act include all of the following

EXCEPT:

- Amount due at lease signing or delivery, itemized by type and amount, including:Refundable security depositAdvance monthly or other periodic paymentCapitalized cost reductionAn itemization of how the amount due will be paid, by type and amount (only required in a motor vehicle lease), using the model form

- Number, amount, and due date of payments scheduled and the total amount of periodic payments

- In an open-end lease, the descriptive statement “You will owe an additional amount if the actual value of the vehicle is less than the residual value”

- If there are multiple items of property, the property description may be separate

Correct answer: D