File Info

| Exam | Certified Trust and Financial Advisor |

| Number | CTFA |

| File Name | Financial.CTFA.Pass4Sure.2018-08-24.400q.vcex |

| Size | 205 KB |

| Posted | Aug 24, 2018 |

| Download | Financial.CTFA.Pass4Sure.2018-08-24.400q.vcex |

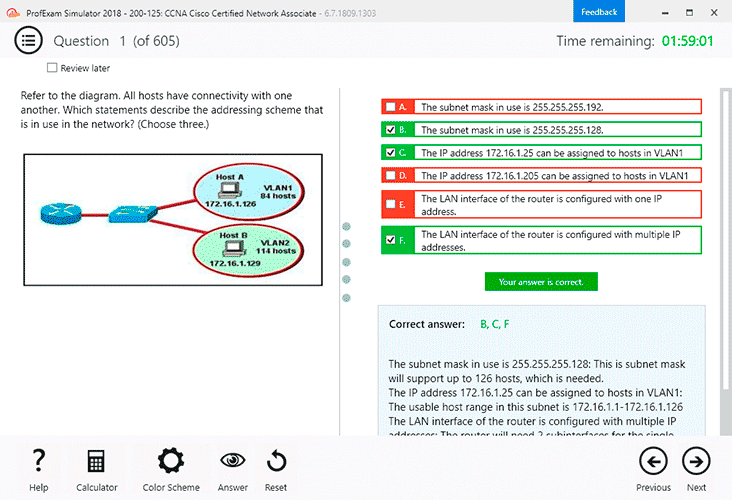

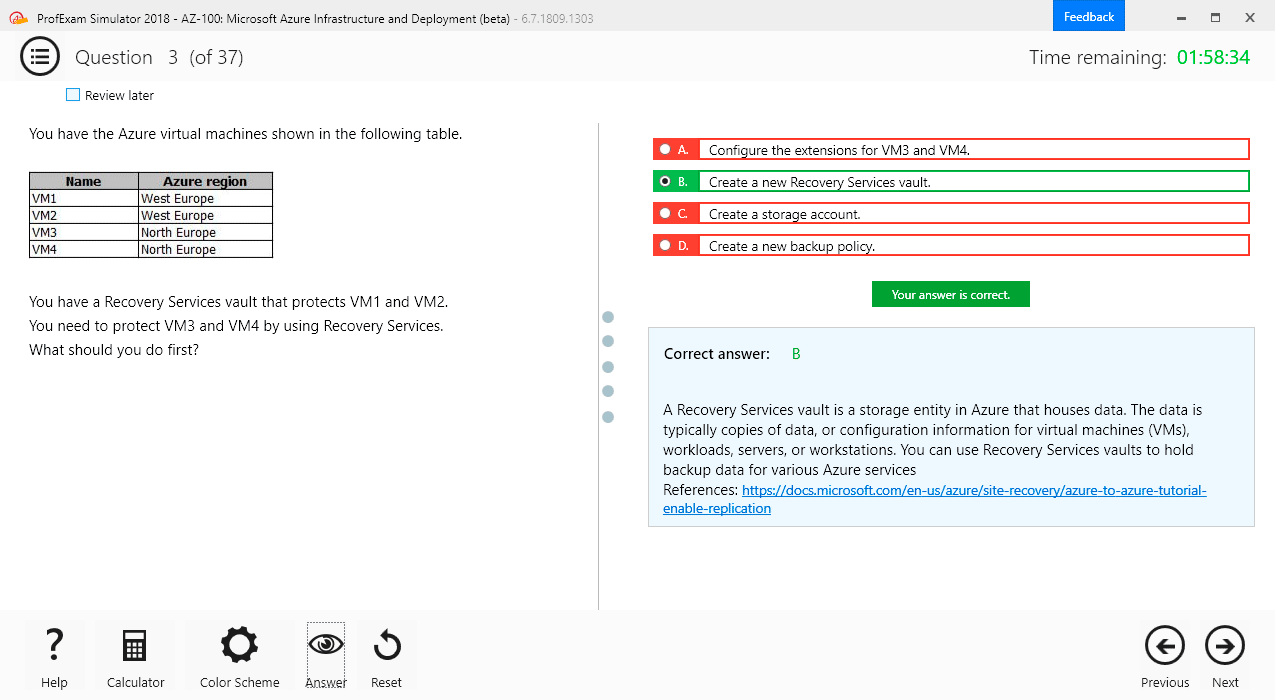

How to open VCEX & EXAM Files?

Files with VCEX & EXAM extensions can be opened by ProfExam Simulator.

Coupon: MASTEREXAM

With discount: 20%

Demo Questions

Question 1

Life insurance is intangible. You can’t see, smell, touch or taste its benefits and those benefits mainly happen when someone is died. However, life insurance does have some important benefits that should not be ignored in the financial planning process. Which of the following is out of those benefits?

- Protection from debtors

- Financial protection from dependents

- Vehicle for savings

- Interest benefit

Correct answer: BC

Question 2

A method of determining the amount of life insurance coverage needed by multiplying gross annual earnings by some selected number is called:

- Multiple of earnings method

- Need analysis method

- Tax saving method

- Whole life coverage

Correct answer: A

Question 3

According to multiple of earnings method, the rule of thumb used by many insurance agents is that your insurance coverage should be equal to 5 to 10 times your current income. For example, if you currently earn $70,000 a year, using the multiple of earning method then you need between:

- $300,000 and $700,000 life insurance

- $400,000 and $700,000 life insurance

- $390,000 and $800,000 life insurance

- $350,000 and $700,000 life insurance

Correct answer: D

Question 4

Need analysis method is a more detailed approach than multiple-of-earnings method. This method considers both financial obligations and financial resources of the insured and his or her dependents. Which of the following steps is/are involved in this method?

- Estimate the total economic resources needed if the individual were to die

- Determine all financial resources that would be available after death, including existing life insurance and pension plan death benefits

- Subtract available resources from the amount needed to determine how much additional life insurance is required

- All of these

Correct answer: D

Question 5

Insurance that provides only death benefits, for a specified period, and does not provide accumulation of cash value is called:

- Straight term policy

- Term life insurance

- Decreasing term policy

- Renewability

Correct answer: B

Question 6

It is a term life policy written for a given number of years with coverage remaining unchanged throughout the effective period. What is it?

- Straight term policy

- Term life insurance

- Decreasing term policy

- Renewability

Correct answer: A

Question 7

It is a term life policy provision allowing the insured to renew the policy at the end of its term without having to show evidence of insurability

- Straight term policy

- Term life insurance

- Decreasing term policy

- Renewability

Correct answer: D

Question 8

Decreasing term policy is:

- A term insurance policy that maintains a level premium throughout all periods of coverage while the amount of protection decreases

- A term insurance policy that maintains a level premium throughout all periods of coverage while the amount of protection increases

- A term insurance policy that maintains a level premium throughout all periods of coverage while the amount of protection remains unchanged

- None of these

Correct answer: D

Question 9

__________ is the accumulated refundable value of an insurance policy; results from the investment earnings on paid-in insurance premiums.

- Cash value

- Nonforefeiture right

- Decreasing term policy

- Continuous premium

Correct answer: A

Question 10

Three major types of whole life policies are available. Which of the following is/are Not out of those?

- Continuous Premium

- Limited Premium

- Single premium

- None of these

Correct answer: D