File Info

| Exam | Certified Trust and Financial Advisor |

| Number | CTFA |

| File Name | Financial.CTFA.PracticeTest.2017-12-13.369q.vcex |

| Size | 219 KB |

| Posted | Dec 13, 2017 |

| Download | Financial.CTFA.PracticeTest.2017-12-13.369q.vcex |

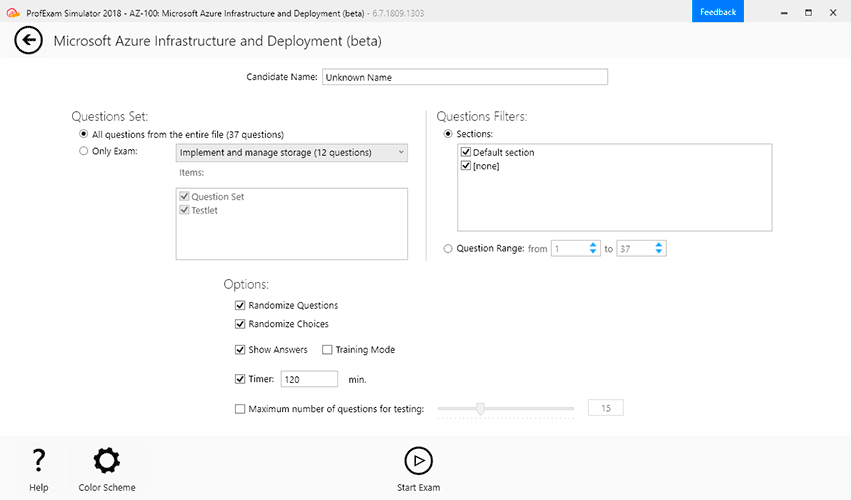

How to open VCEX & EXAM Files?

Files with VCEX & EXAM extensions can be opened by ProfExam Simulator.

Coupon: MASTEREXAM

With discount: 20%

Demo Questions

Question 1

The amount of interest one pays to open credit depends_______ on the method the lender uses to calculate the balances on which they apply finance charges.

- Partly

- Fully

- Quarterly

- None of these

Correct answer: A

Question 2

They say it pays to shop around and when it comes to credit cards that are certainly true. Regardless of which category they fall into, there are basically four credit card features to look for. Which of the following is/are out of those features?

- Annual fees

- Rate of interest charged on account balance

- Length of the expiration period

- Method of calculating balances

Correct answer: C

Question 3

It is a form of legal recourse open to insolvent debtors, who may petition a court for protection from creditors and arrange for the orderly liquidation and distribution of their assets.

- Personal bankruptcy

- Straight bankruptcy

- Wage earn plan

- Both A and B

Correct answer: A

Question 4

It is a legal proceeding that results in “wiping the slate clean and starting anew”; most of the debtor’s obligations are eliminated in an attempt to put the debtor’s financial affairs in order. What is it?

- Personal bankruptcy

- Straight bankruptcy

- Wage earn plan

- Both A and B

Correct answer: B

Question 5

It is a professional financial advisor who assists overextended consumers in repairing budgets for both spending and debt repayment.

- Credit counselor

- Consumer counselor

- Financial planner

- Underwriter

Correct answer: A

Question 6

Loans made for specific purposes using formally negotiated contracts that specify the borrowing terms and repayments are called:

- Mortgage loans

- Credit lines

- Consumer loans

- SME loans

Correct answer: C

Question 7

Collateral is a/an:

- An item of value used to secure the interest amount

- An item of value used to secure the principle portion of a loan

- An item of value used to secure the credit line of a loan

- An item of value used to secure the repayments of a loan

Correct answer: B

Question 8

Student loans are amortized with monthly payments over a period of 5 to 10 years. To help you service the debt, if you have several student loans outstanding then you can consolidate the loans, at a single blended rate, and extend the repayment period to s long as:

- 20 years

- 30 years

- 25 years

- 40 years

Correct answer: A

Question 9

Single payment loan is a loan:

- Made for a specified period

- At the end of which payment is due in full

- At the end of which half of the payment is due

- That expires within a year

Correct answer: AB

Question 10

A loan that is repaid in a series of fixed, scheduled payments rather than a lump-sum is referred to as:

- Single payment loan

- Mortgage loan

- Installment loan

- College savings plan

Correct answer: C