File Info

| Exam | Uniform Securities State Law Examination |

| Number | Series 63 |

| File Name | FINRA.Series 63.PracticeTest.2018-09-22.137q.vcex |

| Size | 166 KB |

| Posted | Sep 22, 2018 |

| Download | FINRA.Series 63.PracticeTest.2018-09-22.137q.vcex |

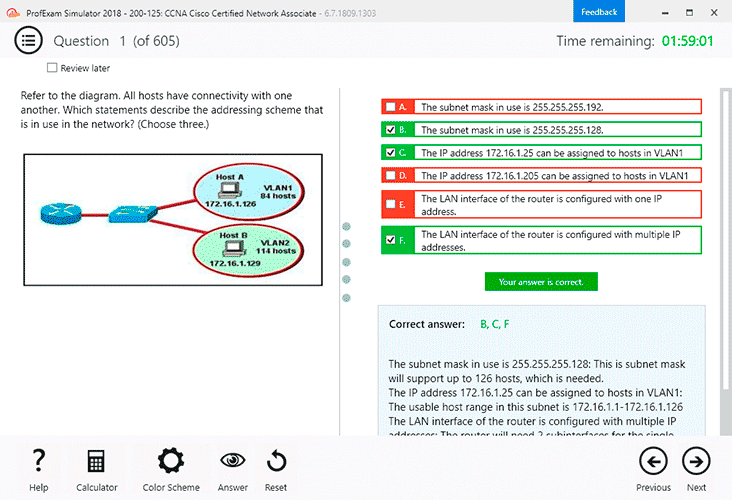

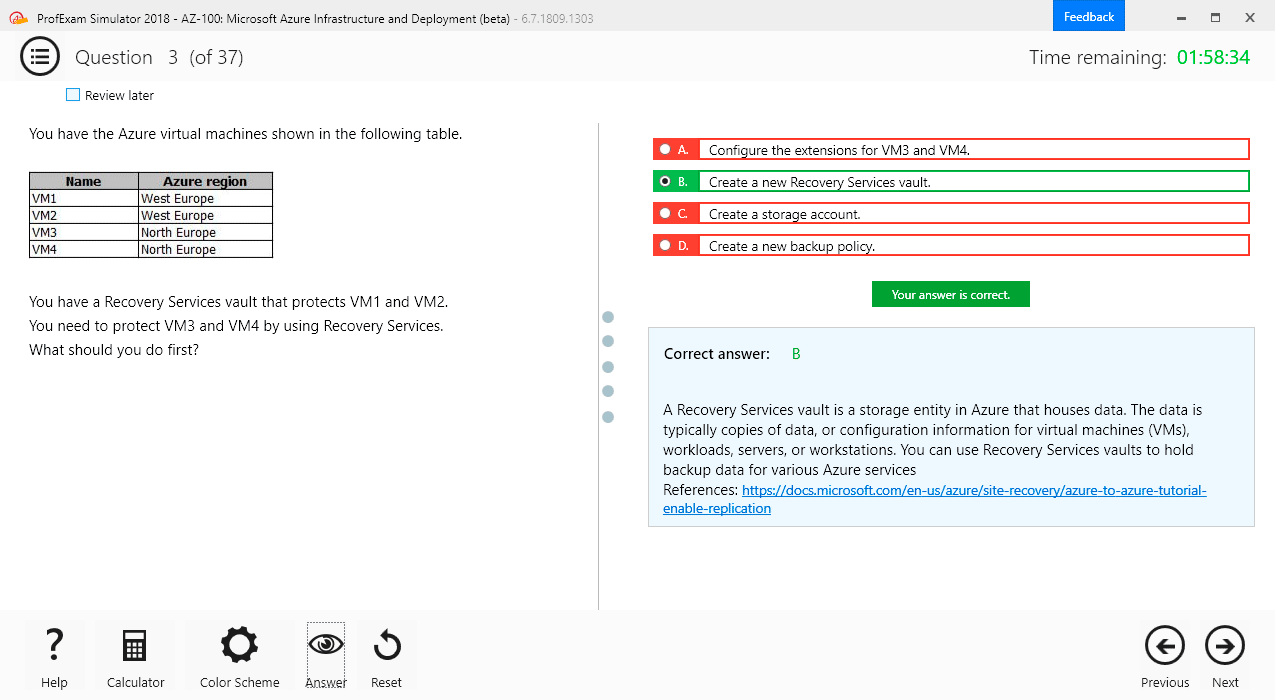

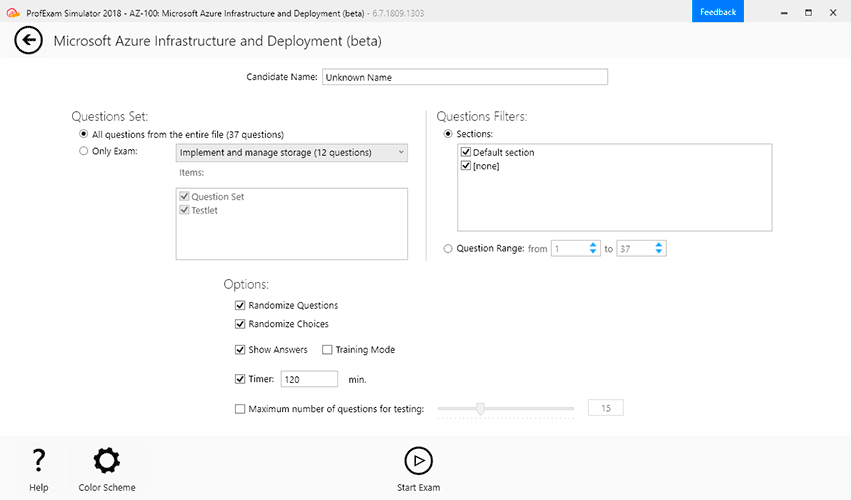

How to open VCEX & EXAM Files?

Files with VCEX & EXAM extensions can be opened by ProfExam Simulator.

Coupon: MASTEREXAM

With discount: 20%

Demo Questions

Question 1

Rich Quick is a broker-dealer licensed in the state of Massachusetts and has offices only within the state. Two of Rich Quick’s clients regularly vacation in Florida during the winter months, and Rich Quick executes trades for them when they call him from out-of-state.

Based on these facts,

I. Rich Quick needs to register as a broker-dealer in the state of Florida as well.

II. Rich Quick needs to register only as an agent in the state of Florida.

III. Rich Quick needs to establish an office in the state of Florida in order to transact business.

IV. Rich Quick need not register in Florida.

- Statements I and III are true.

- Statements II and III are true.

- Only Statement I is true.

- Only Statement IV is true.

Correct answer: D

Explanation:

Based on the facts provided, Rich Quick need not register in Florida since he has no offices in the state of Florida, and he is conducting business for existing clients who are merely vacationing in Florida and are not residents of the state. Based on the facts provided, Rich Quick need not register in Florida since he has no offices in the state of Florida, and he is conducting business for existing clients who are merely vacationing in Florida and are not residents of the state.

Question 2

Most individual state securities laws today are based on:

- the Uniform Securities Act of 1956.

- the Uniform Securities Act of 2002.

- the National Securities Markets Improvement Act of 1996.

- the Gramm-Leach-Bliley Act of 1999.

Correct answer: A

Explanation:

Most individual state securities laws continue to be based on the 1956 Uniform Securities Act. Although the Uniform Securities Act was revised in 1985, 1988, and 2002, none of these revisions have been widely incorporated by the individual states. The National Securities Markets Improvement Act of 1996 dealt mainly with the definition of federal covered securities and more efficient management of mutual funds. The focus of the Gramm-Leach-Bliley Act of 1999 was on financial institutions. Most individual state securities laws continue to be based on the 1956 Uniform Securities Act. Although the Uniform Securities Act was revised in 1985, 1988, and 2002, none of these revisions have been widely incorporated by the individual states. The National Securities Markets Improvement Act of 1996 dealt mainly with the definition of federal covered securities and more efficient management of mutual funds. The focus of the Gramm-Leach-Bliley Act of 1999 was on financial institutions.

Question 3

BigCash Broker-Dealers is registered in the state and is in the process of purchasing a smaller broker-dealer, Target Investments, as a subsidiary. Target Investments is also registered in the state.

After completing the purchase, what actions must BigCash take regarding registration of its new subsidiary?

- BigCash need do nothing since Target Investments was already duly registered with the state as a broker-dealer.

- BigCash must file a new application with the state to register its new subsidiary, but will be able to utilize the remainder of any annual filing fees that Target Investments had paid for the year.

- BigCash must file a new application with the state to register its new subsidiary and must also pay the annual filing fees required by the Administrator.

- BigCash will need to pay the annual filing fees required by the Administrator, but will not need to file a new registration application.

Correct answer: B

Explanation:

After completing the purchase, BigCash will have to file a new registration application for its new subsidiary, but BigCash can utilize the remainder of any annual filing fees that Target Investments had paid for the year. Although registration applications are never transferable, annual filing fees are. After completing the purchase, BigCash will have to file a new registration application for its new subsidiary, but BigCash can utilize the remainder of any annual filing fees that Target Investments had paid for the year. Although registration applications are never transferable, annual filing fees are.

Question 4

In order to maintain its registration with a state, a broker-dealer may be required to:

I. take a written or oral exam.

II. pay an annual filing fee.

III. maintain a minimum net capital.

IV. file all advertising material with the Administrator

- I and II only

- II and III only

- II, III, and IV only

- I, II, III, and IV

Correct answer: D

Explanation:

In order to maintain its registration with a state, a broker-dealer may be required to take a written or oral exam, pay an annual filing fee, maintain a minimum net capital, and file all advertising material with the state’s Administrator. The Administrator of each state has the authority to determine the specific requirements for the state. All of the selections are within the realm of the Administrator’s jurisdiction. In order to maintain its registration with a state, a broker-dealer may be required to take a written or oral exam, pay an annual filing fee, maintain a minimum net capital, and file all advertising material with the state’s Administrator. The Administrator of each state has the authority to determine the specific requirements for the state. All of the selections are within the realm of the Administrator’s jurisdiction.

Question 5

Once a broker-dealer has applied for and been granted state registration, the registration remains valid

- until December 31st.

- for twelve months.

- for three years.

- for five years.

Correct answer: A

Explanation:

Once a broker-dealer has been granted state registration, that registration is valid until December 31st of that year. Registration automatically terminates annually on December 31st although an Administrator may elect to revoke or suspend a broker-dealer’s registration at any time if the Administrator finds just cause. Once a broker-dealer has been granted state registration, that registration is valid until December 31st of that year. Registration automatically terminates annually on December 31st although an Administrator may elect to revoke or suspend a broker-dealer’s registration at any time if the Administrator finds just cause.

Question 6

A broker-dealer is required to keep his records for how long?

- at least three years

- at least five years

- at least seven years

- broker-dealer is required to keep his records for as long as he is registered in the state.

Correct answer: A

Explanation:

A broker dealer is required to keep his records at least three years. A broker dealer is required to keep his records at least three years.

Question 7

Which of the following entities would be required to register with the state as a broker-dealer under the guidelines of the Uniform Securities Act (USA)?

- an underwriter with no offices in the state that is helping a firm that is incorporated within the state with the sale of its new bond issue to insurance companies.

- a credit union that operates within the state and provides loans to its members.

- an agent who executes the purchase and sale of stocks and bonds for his clients.

- None of the above entities would be required to register with the state as a broker-dealer under the guidelines of the Uniform Securities Act.

Correct answer: D

Explanation:

Under the guidelines of the USA, none of the entities described in Selections A, B, or C would be required to register with the state as a broker-dealer since the term, as defined by the USA, does not include agents, savings institutions, or entities with no offices in the state who deal exclusively with issuers and/or other broker-dealers, financial institutions, insurance companies, pension funds, or insurance companies. Selections B and C refer to a financial institution and an agent, respectively. In the scenario described in Selection A, the underwriter has no offices in the state and is dealing exclusively with the issuer of the bonds and insurance companies. Under the guidelines of the USA, none of the entities described in Selections A, B, or C would be required to register with the state as a broker-dealer since the term, as defined by the USA, does not include agents, savings institutions, or entities with no offices in the state who deal exclusively with issuers and/or other broker-dealers, financial institutions, insurance companies, pension funds, or insurance companies. Selections B and C refer to a financial institution and an agent, respectively. In the scenario described in Selection A, the underwriter has no offices in the state and is dealing exclusively with the issuer of the bonds and insurance companies.

Question 8

Joe Romeo is a broker-dealer registered with the state. He has recently hired Betty Buxom as his administrative assistant. As part of her duties, he has given her the responsibility for effecting the purchases and sales of securities for some of his firm’s smaller accounts. Ms. Buxom has never applied for nor been granted registration as a broker-dealer or agent. Based on these facts,

- the Administrator is required by the Uniform Securities Act to revoke Joe Romeo’s registration and file criminal and civil charges against him.

- there is no problem as long as Ms. Buxom registers with the state as an agent within thirty days.

- the Administrator may elect to revoke or suspend Joe Romeo’s registration, and Joe may also face both civil and criminal penalties.

- the Administrator is required to turn the case over to the state’s district attorney, who will file criminal charges against both Joe Romeo and Betty Buxom.

Correct answer: C

Explanation:

Since Joe Romeo has allowed Betty Buxom to execute trades, a duty that can legally be performed only by a registered broker-dealer or agent, the Administrator may elect to revoke or suspend Joe Romeo’s registration, and Joe may also face civil and criminal penalties. Ms. Buxom needed to be registered as an agent prior to effecting any transactions in the securities markets; there is no grace period. The Administrator is not required to take any action, however. Since Joe Romeo has allowed Betty Buxom to execute trades, a duty that can legally be performed only by a registered broker-dealer or agent, the Administrator may elect to revoke or suspend Joe Romeo’s registration, and Joe may also face civil and criminal penalties. Ms. Buxom needed to be registered as an agent prior to effecting any transactions in the securities markets; there is no grace period. The Administrator is not required to take any action, however.

Question 9

Until yesterday Maddie was a registered agent employed by the broker-dealer, QuikDeals. Yesterday afternoon, issues that had been brewing between her and another employee of the firm came to a head, and Maddie impulsively quit her job.

At this point,

- Maddie has thirty days to find a job with another broker-dealer, or she will need to file a new registration application.

- Maddie has sixty days to find a job with another broker-dealer, or she will need to file a new registration application.

- Maddie will have to file a new application for registration with the Administrator upon finding employment with another broker-dealer since she is no longer considered to be a registered agent by the state.

- Maddie is required to call all of her clients at QuikDeals to inform them she is no longer employed there.

Correct answer: C

Explanation:

When Maddie quit her job, her status as a state-registered securities agent was automatically terminated, and she will need to file a new application for registration with the Administrator upon obtaining a position with another broker-dealer. If she does so within thirty days, her registration will become effective as soon as she has filed her application and paid her application fee. While she is required to notify the Administrator that she has terminated her employment with QuikDeals, there is no requirement that she contact any of her clients at QuikDeals. When Maddie quit her job, her status as a state-registered securities agent was automatically terminated, and she will need to file a new application for registration with the Administrator upon obtaining a position with another broker-dealer. If she does so within thirty days, her registration will become effective as soon as she has filed her application and paid her application fee. While she is required to notify the Administrator that she has terminated her employment with QuikDeals, there is no requirement that she contact any of her clients at QuikDeals.

Question 10

Ms. Ding is an administrative assistant to the manager of a mutual fund. Most of her day is spent entering data onto a spreadsheet for her boss and answering phone calls. Some of the calls require her to provide information about the some of the fund’s financial aspects, such as its closing net asset value on the previous day.

What type of registration does Ms. Ding require in order to perform her duties?

- Ms. Ding needs to apply for registration as an agent since she is providing financial information.

- Ms. Ding needs to apply for registration as an investment adviser representative since she is providing information about a specific mutual fund.

- Ms. Ding will need to apply for registration as both an agent and an investment adviser representative in this case since she is providing information about a mutual fund.

- Ms. Ding does not need to apply for any type of registration. She is merely supplying information and is not engaged in the purchase or sale of the fund shares.

Correct answer: D

Explanation:

Since Ms. Ding is an administrative assistant who is merely providing some information about the fund and is not engaging in the purchase or sale of the fund shares, she does not need to apply for any type of registration. An employee who simply provides price and/or some other pertinent information to the public, but who does not engage in the purchase or sale of securities to the public and does not receive a commission based on the sale of securities is not considered to be an agent or an investment adviser. Since Ms. Ding is an administrative assistant who is merely providing some information about the fund and is not engaging in the purchase or sale of the fund shares, she does not need to apply for any type of registration. An employee who simply provides price and/or some other pertinent information to the public, but who does not engage in the purchase or sale of securities to the public and does not receive a commission based on the sale of securities is not considered to be an agent or an investment adviser.