File Info

| Exam | International Certificate in Banking Risk and Regulation (ICBRR) |

| Number | ICBRR |

| File Name | GARP.ICBRR.SelfTestEngine.2020-03-18.205q.vcex |

| Size | 161 KB |

| Posted | Mar 18, 2020 |

| Download | GARP.ICBRR.SelfTestEngine.2020-03-18.205q.vcex |

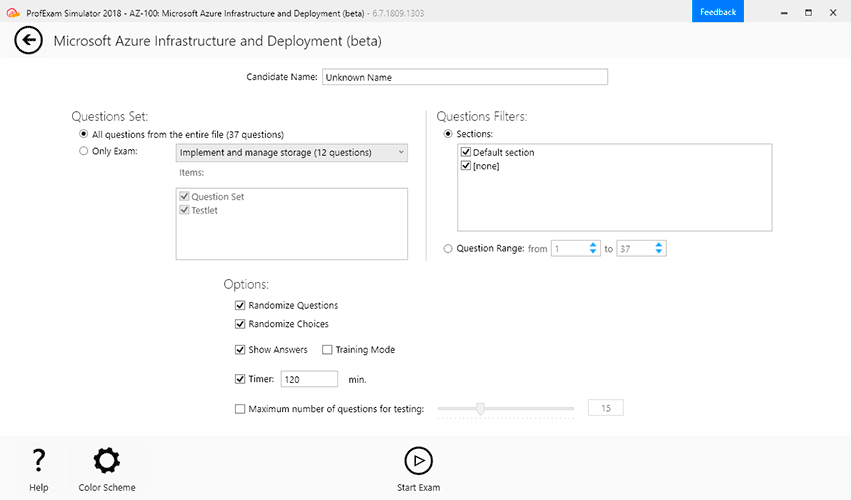

How to open VCEX & EXAM Files?

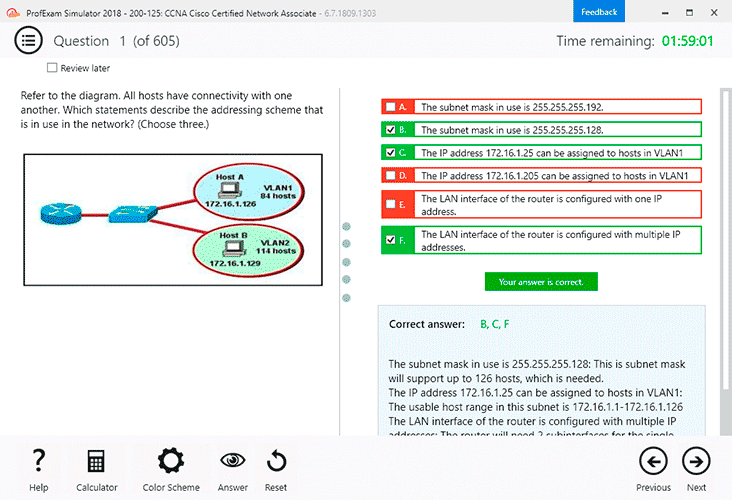

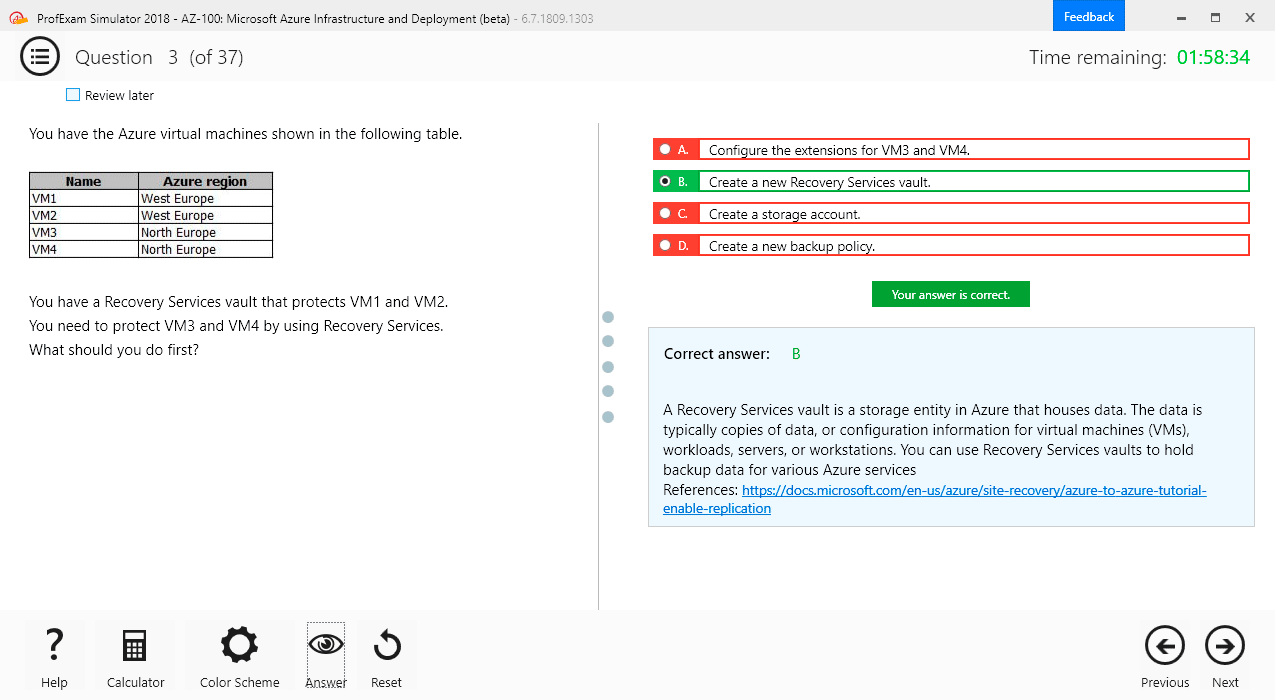

Files with VCEX & EXAM extensions can be opened by ProfExam Simulator.

Coupon: MASTEREXAM

With discount: 20%

Demo Questions

Question 1

Which one of the following four statements correctly defines credit risk?

- Credit risk is the risk that complements market and liquidity risks.

- Credit risk is a form of performance risk in contractual relationship.

- Credit risk is the risk arising from execution of a company's strategy.

- Credit risk is the risk that summarizes the exposures a company or firm assumes when it attempts to operate within a given field or industry.

Correct answer: B

Question 2

To estimate the interest charges on the loan, an analyst should use one of the following four formulas:

- Loan interest = Risk-free rate - Probability of default x Loss given default + Spread

- Loan interest = Risk-free rate + Probability of default x Loss given default + Spread

- Loan interest = Risk-free rate - Probability of default x Loss given default - Spread

- Loan interest = Risk-free rate + Probability of default x Loss given default - Spread

Correct answer: B

Question 3

Alpha Bank determined that Delta Industrial Machinery Corporation has 2% change of default on a one-year no-payment of USD $1 million, including interest and principal repayment. The bank charges 3% interest rate spread to firms in the machinery industry, and the risk-free interest rate is 6%. Alpha Bank receives both interest and principal payments once at the end the year. Delta can only default at the end of the year. If Delta defaults, the bank expects to lose 50% of its promised payment. Hence, the loss rate in this case will be

- 1%

- 3%

- 5%

- 10%

Correct answer: A

Question 4

Alpha Bank determined that Delta Industrial Machinery Corporation has 2% change of default on a one-year no-payment of USD $1 million, including interest and principal repayment. The bank charges 3% interest rate spread to firms in the machinery industry, and the risk-free interest rate is 6%. Alpha Bank receives both interest and principal payments once at the end the year. Delta can only default at the end of the year. If Delta defaults, the bank expects to lose 50% of its promised payment. What interest rate should Alpha Bank charge on the no-payment loan to Delta Industrial Machinery Corporation?

- 8%

- 9%

- 10%

- 12%

Correct answer: C

Question 5

Which one of the following four models is typically used to grade the obligations of small- and medium-size enterprises?

- Causal models

- Historical frequency models

- Credit scoring models

- Credit rating models

Correct answer: C

Question 6

A bank customer chooses a mortgage with low initial payments and payments that increase over time because the customer knows that she will have trouble making payments in the early years of the loan. The bank makes this type of mortgage with the same default assumptions uses for ordinary mortgages, thus underestimating the risk of default and becoming exposed to:

- Moral hazard

- Adverse selection

- Banking speculation

- Sampling bias

Correct answer: B

Question 7

The potential failure of a manufacturer to honor a warranty might be called ____, whereas the potential failure of a borrower to fulfill its payment requirements, which include both the repayment of the amount borrowed, the principal and the contractual interest payments, would be called ___.

- Credit risk; market risk

- Market risk; credit risk

- Credit risk; performance risk

- Performance risk; credit risk

Correct answer: D

Question 8

Which one of the following four options does NOT represent a benefit of compensating balances to the bank?

- Compensating balances allow the bank to net some of the exposure they may have in case of default, by taking funds from these specific deposit account one the borrower defaults.

- Since the compensating balances cannot be withdrawn at short notice, if at all, they are not considered transaction accounts and are able to provide a stable funding to the bank, reducing its reliance on more volatile external inter-bank based funding sources.

- Compensation balances influence the expected loss rate of the bank given the default obligor and improve capital structure by controlling obligor type and avoiding payment delays.

- Since the compensating balances reduce the next amount lent to the borrower, the earned return on the loan is increased, further widening the bank's interest rate margin and profitability.

Correct answer: C

Question 9

According to a Moody's study, the most important drivers of the loss given default historically have been all of the following EXCEPT:

I. Debt type and seniority

II. Macroeconomic environment

III. Obligor asset type

IV. Recourse

- I

- II

- I, II

- III, IV

Correct answer: D

Question 10

In the United States, Which one of the following four options represents the largest component of securitized debt?

- Education loans

- Credit card loans

- Real estate loans

- Lines of credit

Correct answer: C