File Info

| Exam | Excel 2013 Expert Part One |

| Number | 77-427 |

| File Name | Microsoft.77-427.BrainDumps.2018-06-19.37q.tqb |

| Size | 3 MB |

| Posted | Jun 19, 2018 |

| Download | Microsoft.77-427.BrainDumps.2018-06-19.37q.tqb |

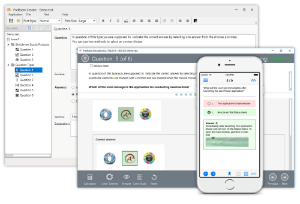

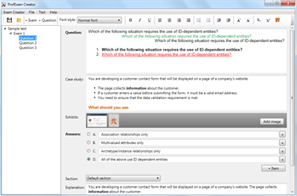

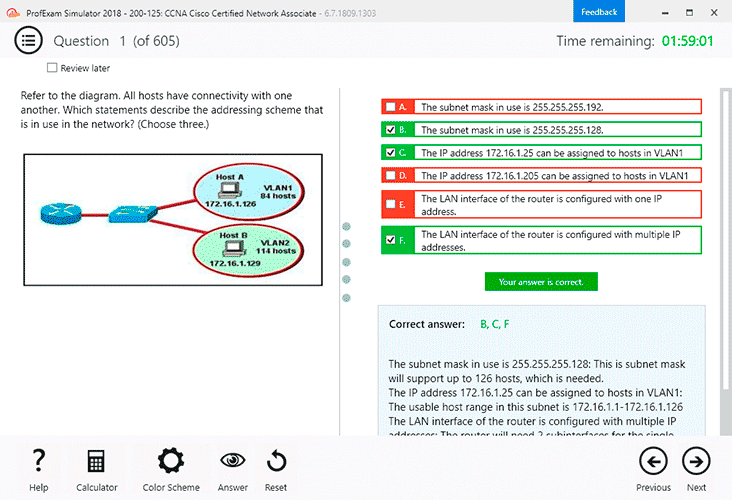

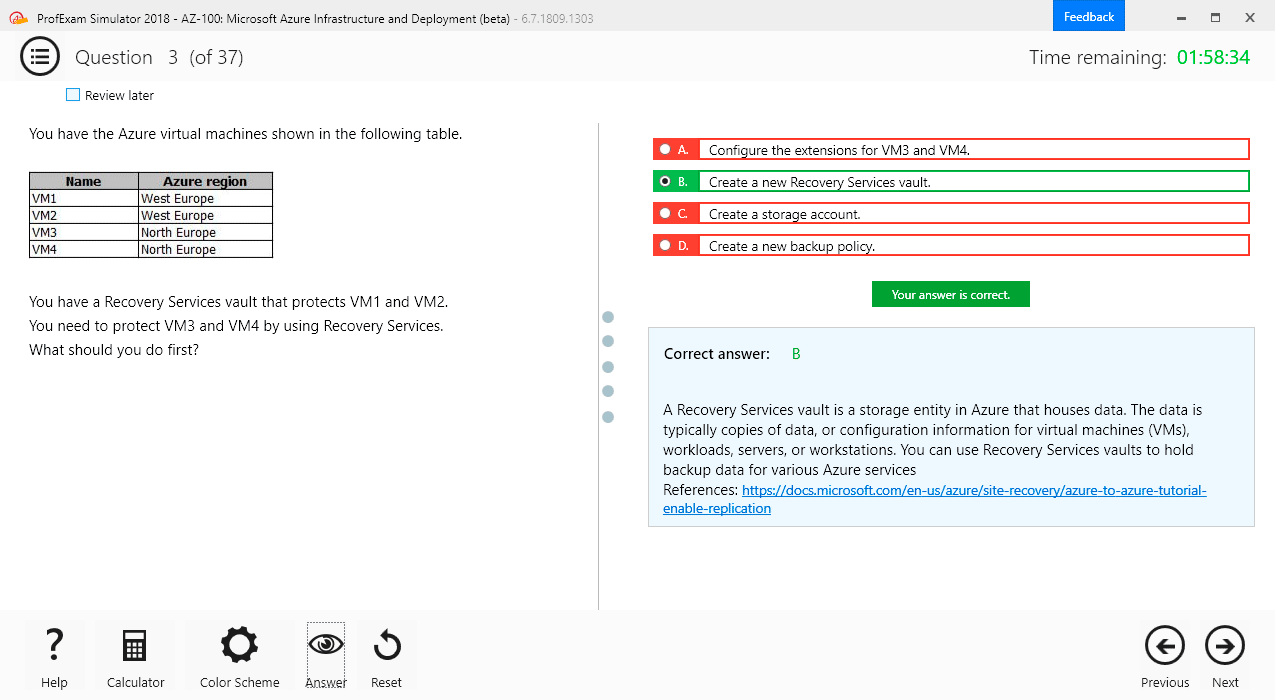

How to open VCEX & EXAM Files?

Files with VCEX & EXAM extensions can be opened by ProfExam Simulator.

Coupon: MASTEREXAM

With discount: 20%

Demo Questions

Question 1

Rick works as an Office Assistant for Tech Perfect Inc. The company has a Windows- based network. He is creating a form through Microsoft Excel 2013.

He wants to enable worksheet forms to satisfy the flexible design requirements and to customize their appearance, behavior, fonts, and other characteristics.

Which of the following will Rick use to accomplish the task?

- Form control

- Accounting template

- Trust Center

- ActiveX control

Correct answer: D

Explanation:

ActiveX controls are used on worksheet forms, with or without the use of VBA code, and on VBA UserForms. They are used when a user needs more flexible design requirements than those provided by Form controls. They have extensive properties that can be used to customize their appearance, behavior, fonts, and other characteristics. The user can control different events that occur when an ActiveX control is interacted with. He can also write macros that respond to events associated with the ActiveX controls. When a user interacts with the control, the VBA code runs to process any events that occur for that control. The ActiveX controls cannot be added to chart sheets from the user interface or to XLM macro sheets. It is not possible to assign a macro to run directly from the ActiveX control. Incorrect Answers:A: A form control is an original control that is compatible with old versions of Excel, beginning with Excel version 5. 0. It is designed for use on XLM macro sheets. It can be used when a user wants to simply interact with cell data without using VBA code and when he wants to add controls to chart sheets. By using form controls, the user can run macros. He can attach an existing macro to a control, or write or record a new macro. These controls cannot be added to UserForms, used to control events, or modified to run Web scripts on Web pages.B: The accounting template is used for numbering months of a financial year to period numbering. It is used to compare month to month, actual v budget, quarter to quarter, year to year variances. It is the initial point for other reports that need the use of months.C: Trust Center is where a user can find security and privacy settings for Microsoft Office 2013 programs.References: https://support.office.com/en-us/article/overview-of-forms-form-controls-and-activex-controls-on-a-worksheet-15ba7e28-8d7f-42ab-9470-ffb9ab94e7c2 ActiveX controls are used on worksheet forms, with or without the use of VBA code, and on VBA UserForms. They are used when a user needs more flexible design requirements than those provided by Form controls. They have extensive properties that can be used to customize their appearance, behavior, fonts, and other characteristics. The user can control different events that occur when an ActiveX control is interacted with. He can also write macros that respond to events associated with the ActiveX controls. When a user interacts with the control, the VBA code runs to process any events that occur for that control. The ActiveX controls cannot be added to chart sheets from the user interface or to XLM macro sheets. It is not possible to assign a macro to run directly from the ActiveX control.

Incorrect Answers:

A: A form control is an original control that is compatible with old versions of Excel, beginning with Excel version 5. 0. It is designed for use on XLM macro sheets. It can be used when a user wants to simply interact with cell data without using VBA code and when he wants to add controls to chart sheets. By using form controls, the user can run macros. He can attach an existing macro to a control, or write or record a new macro. These controls cannot be added to UserForms, used to control events, or modified to run Web scripts on Web pages.

B: The accounting template is used for numbering months of a financial year to period numbering. It is used to compare month to month, actual v budget, quarter to quarter, year to year variances. It is the initial point for other reports that need the use of months.

C: Trust Center is where a user can find security and privacy settings for Microsoft Office 2013 programs.

References: https://support.office.com/en-us/article/overview-of-forms-form-controls-and-activex-controls-on-a-worksheet-15ba7e28-8d7f-42ab-9470-ffb9ab94e7c2

Question 2

You work as a Finance Manager for Blue Well Inc. The company has a Windows-based network.

You are using Excel spreadsheet for maintaining the financial budget and other financial calculations. You want to return the price per $100 face value of a security that pays interest at maturity.

Which of the following financial functions will you use to accomplish the task?

- PRICE function

- PPMT function

- PRICEMAT function

- PRICEDISC function

Correct answer: C

Explanation:

Various financial functions (reference) are as follows:1. ACCRINT function: It is used to return the accrued interest for a security that pays periodic interest.2. ACCRINTM function: It is used to return the accrued interest for a security that pays interest at maturity.3. AMORDEGRC function: It is used to return the depreciation for each accounting period by using a depreciation coefficient.4. COUPDAYBS function: It is used to return the number of days from the beginning of the coupon period to the settlement date.5. AMORLINC function: It is used to return the depreciation for each accounting period.6. COUPDAYS function: It is used to return the number of days in the coupon period containing the settlement date.7. COUPDAYSNC function: It is used to return the number of days from the settlement date to the next coupon date.8. COUPNCD function: It is used to return the next coupon date after the settlement date.9. COUPNUM function: It is used to return the number of coupons payable between the settlement date and maturity date.10. COUPPCD function: It is used to return the previous coupon date before the settlement date.11. CUMIPMT function: It is used to return the cumulative interest paid between two periods.12. CUMPRINC function: It is used to return the cumulative principal paid on a loan between two periods.13. DB function: It is used to return the depreciation of an asset for a specified period by using the fixed-declining balance method.14. DDB function: It is used to return the depreciation of an asset for a particular period by using the double-declining balance method.15. DISC function: It is used to return the discount rate for a security.16. DOLLARDE function: It is used to convert a dollar price that is expressed as a fraction into a dollar price that is expressed as a decimal number.17. DOLLARFR function: It is used to convert a dollar price that is expressed as a decimal number into a dollar price that is expressed as a fraction.18. DURATION function: It is used to return the annual duration of a security with periodic interest payments.19. EFFECT function: It is used to return the effective annual interest rate.20. FV function: It is used to return the future value of an investment.21. FVSCHEDULE function: It is used to return the future value of a starting principal after applying a series of compound interest rates.22. INTRATE function: It is used to return the interest rate for a fully invested security.23. IPMT function: It is used to return the interest payment for an investment for a specified period.24. IRR function: It is used to return the internal rate of return for a series of cash flows.25. ISPMT function: It is used to calculate the interest paid during a particular period of an investment.26. MDURATION function: It is used to return the Macauley modified duration for a security with an assumed par value of $100.27. MIRR function: It is used to return the internal rate of return in which positive and negative cash flows are financed at different rates.28. NOMINAL function: It is used to return the annual nominal interest rate.29. NPER function: It is used to return the number of periods for an investment.30. NPV function: It is used to return the net present value of an investment on the basis of a series of periodic cash flows and a discount rate.31. ODDFPRICE function: It is used to return the price per $100 face value of a security with an odd first period.32. ODDFYIELD function: It is used to return the yield of a security with an odd first period.33. ODDLPRICE function: It is used to return the price per $100 face value of a security with an odd last period.34. ODDLYIELD function: It is used to return the yield of a security with an odd last period.35. PMT function: It is used to return the periodic payment for an annuity.36. PPMT function: It is used to return the payment on the principal for an investment for a particular defined period.37. PRICE function: It is used to return the price per $100 face value of a security that pays periodic interest.38. PRICEDISC function: It is used to return the price per $100 face value of a discounted security.39. PRICEMAT function: It is used to return the price per $100 face value of a security that pays interest at maturity.40. PV function: It is used to return the current value of an investment.41. RATE function: It is use d to return the interest rate per period of an annuity.42. RECEIVED function: It is used to return the amount received at maturity for a fully invested security.43. SLN function: It is used to return the straight-line depreciation of an asset for one period.44. SYD function: It is used to return the sum-of-years' digits depreciation of an asset for a particular period.45. TBILLEQ function: It is used to return the bond-equivalent yield for a Treasury bill.46. TBILLPRICE function: It is used to return the price per $100 face value for a Treasury bill.47. TBILLYIELD function: It is used to return the yield for a Treasury bill.48. VDB function: It is used to return the depreciation of an asset for a specified or partial period by using a declining balance method.49. XIRR function: It is used to return the internal rate of return for a schedule of cash flows that is not necessarily periodic.50. XNPV function: It is used to return the net present value for a schedule of cash flows that is not necessarily periodic.51. YIELD function: It is used to return the yield on a security that pays periodic interest.52. YIELDDISC function: It is used to return the annual yield for a discounted security.53. YIELDMAT function: It is used to return the annual yield of a security that pays interest at maturity.References: https://support.office.com/en-us/article/pricemat-function-52c3b4da-bc7e-476a-989f-a95f675cae77 Various financial functions (reference) are as follows:

1. ACCRINT function: It is used to return the accrued interest for a security that pays periodic interest.

2. ACCRINTM function: It is used to return the accrued interest for a security that pays interest at maturity.

3. AMORDEGRC function: It is used to return the depreciation for each accounting period by using a depreciation coefficient.

4. COUPDAYBS function: It is used to return the number of days from the beginning of the coupon period to the settlement date.

5. AMORLINC function: It is used to return the depreciation for each accounting period.

6. COUPDAYS function: It is used to return the number of days in the coupon period containing the settlement date.

7. COUPDAYSNC function: It is used to return the number of days from the settlement date to the next coupon date.

8. COUPNCD function: It is used to return the next coupon date after the settlement date.

9. COUPNUM function: It is used to return the number of coupons payable between the settlement date and maturity date.

10. COUPPCD function: It is used to return the previous coupon date before the settlement date.

11. CUMIPMT function: It is used to return the cumulative interest paid between two periods.

12. CUMPRINC function: It is used to return the cumulative principal paid on a loan between two periods.

13. DB function: It is used to return the depreciation of an asset for a specified period by using the fixed-declining balance method.

14. DDB function: It is used to return the depreciation of an asset for a particular period by using the double-declining balance method.

15. DISC function: It is used to return the discount rate for a security.

16. DOLLARDE function: It is used to convert a dollar price that is expressed as a fraction into a dollar price that is expressed as a decimal number.

17. DOLLARFR function: It is used to convert a dollar price that is expressed as a decimal number into a dollar price that is expressed as a fraction.

18. DURATION function: It is used to return the annual duration of a security with periodic interest payments.

19. EFFECT function: It is used to return the effective annual interest rate.

20. FV function: It is used to return the future value of an investment.

21. FVSCHEDULE function: It is used to return the future value of a starting principal after applying a series of compound interest rates.

22. INTRATE function: It is used to return the interest rate for a fully invested security.

23. IPMT function: It is used to return the interest payment for an investment for a specified period.

24. IRR function: It is used to return the internal rate of return for a series of cash flows.

25. ISPMT function: It is used to calculate the interest paid during a particular period of an investment.

26. MDURATION function: It is used to return the Macauley modified duration for a security with an assumed par value of $100.

27. MIRR function: It is used to return the internal rate of return in which positive and negative cash flows are financed at different rates.

28. NOMINAL function: It is used to return the annual nominal interest rate.

29. NPER function: It is used to return the number of periods for an investment.

30. NPV function: It is used to return the net present value of an investment on the basis of a series of periodic cash flows and a discount rate.

31. ODDFPRICE function: It is used to return the price per $100 face value of a security with an odd first period.

32. ODDFYIELD function: It is used to return the yield of a security with an odd first period.

33. ODDLPRICE function: It is used to return the price per $100 face value of a security with an odd last period.

34. ODDLYIELD function: It is used to return the yield of a security with an odd last period.

35. PMT function: It is used to return the periodic payment for an annuity.

36. PPMT function: It is used to return the payment on the principal for an investment for a particular defined period.

37. PRICE function: It is used to return the price per $100 face value of a security that pays periodic interest.

38. PRICEDISC function: It is used to return the price per $100 face value of a discounted security.

39. PRICEMAT function: It is used to return the price per $100 face value of a security that pays interest at maturity.

40. PV function: It is used to return the current value of an investment.

41. RATE function: It is use d to return the interest rate per period of an annuity.

42. RECEIVED function: It is used to return the amount received at maturity for a fully invested security.

43. SLN function: It is used to return the straight-line depreciation of an asset for one period.

44. SYD function: It is used to return the sum-of-years' digits depreciation of an asset for a particular period.

45. TBILLEQ function: It is used to return the bond-equivalent yield for a Treasury bill.

46. TBILLPRICE function: It is used to return the price per $100 face value for a Treasury bill.

47. TBILLYIELD function: It is used to return the yield for a Treasury bill.

48. VDB function: It is used to return the depreciation of an asset for a specified or partial period by using a declining balance method.

49. XIRR function: It is used to return the internal rate of return for a schedule of cash flows that is not necessarily periodic.

50. XNPV function: It is used to return the net present value for a schedule of cash flows that is not necessarily periodic.

51. YIELD function: It is used to return the yield on a security that pays periodic interest.

52. YIELDDISC function: It is used to return the annual yield for a discounted security.

53. YIELDMAT function: It is used to return the annual yield of a security that pays interest at maturity.

References: https://support.office.com/en-us/article/pricemat-function-52c3b4da-bc7e-476a-989f-a95f675cae77

Question 3

Rick works as an Office Assistant for Tech Perfect Inc. He is creating a report through Microsoft Excel 2013. Rick wants to interact with cell data but his computer does not contain VBA code and few features of his computer are still Excel 5. 0 features.

Which of the following will Rick use to accomplish the task?

- Accounting template

- Trust Center

- Form control

- Evaluate Formula

Correct answer: C

Explanation:

A form control is an original control that is compatible with old versions of Excel, beginning with Excel version 5. 0. It is designed for use on XLM macro sheets. It can be used when a user wants to simply interact with cell data without using VBA code and when he wants to add controls to chart sheets. By using form controls, the user can run macros. He can attach an existing macro to a control, or write or record a new macro. These controls cannot be added to UserForms, used to control events, or modified to run Web scripts on Web pages. Incorrect Answers:A: The accounting template is used for numbering months of a financial year to period numbering. It is used to compare month to month, actual v budget, quarter to quarter, year to year variances. It is the initial point for other reports that need the use of months.B: Trust Center is where a user can find security and privacy settings for Microsoft Office 2013 programs.D: Evaluate Formula is the formula examination tool provided by Microsoft Excel. This tool is useful for examining formulas that do not produce any error but are not generating the expected result.References: https://support.office.com/en-us/article/overview-of-forms-form-controls-and-activex-controls-on-a-worksheet-15ba7e28-8d7f-42ab-9470-ffb9ab94e7c2 A form control is an original control that is compatible with old versions of Excel, beginning with Excel version 5. 0. It is designed for use on XLM macro sheets. It can be used when a user wants to simply interact with cell data without using VBA code and when he wants to add controls to chart sheets. By using form controls, the user can run macros. He can attach an existing macro to a control, or write or record a new macro. These controls cannot be added to UserForms, used to control events, or modified to run Web scripts on Web pages.

Incorrect Answers:

A: The accounting template is used for numbering months of a financial year to period numbering. It is used to compare month to month, actual v budget, quarter to quarter, year to year variances. It is the initial point for other reports that need the use of months.

B: Trust Center is where a user can find security and privacy settings for Microsoft Office 2013 programs.

D: Evaluate Formula is the formula examination tool provided by Microsoft Excel. This tool is useful for examining formulas that do not produce any error but are not generating the expected result.

References: https://support.office.com/en-us/article/overview-of-forms-form-controls-and-activex-controls-on-a-worksheet-15ba7e28-8d7f-42ab-9470-ffb9ab94e7c2