File Info

| Exam | Oracle Financials Cloud: Payables 2018 Implementation Essentials |

| Number | 1z0-1005 |

| File Name | Oracle.1z0-1005.Pass4Sure.2019-10-23.43q.vcex |

| Size | 27 KB |

| Posted | Oct 23, 2019 |

| Download | Oracle.1z0-1005.Pass4Sure.2019-10-23.43q.vcex |

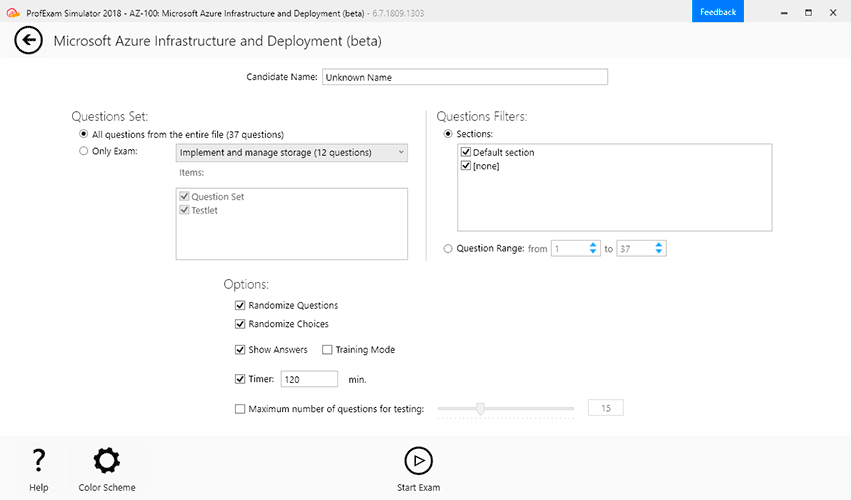

How to open VCEX & EXAM Files?

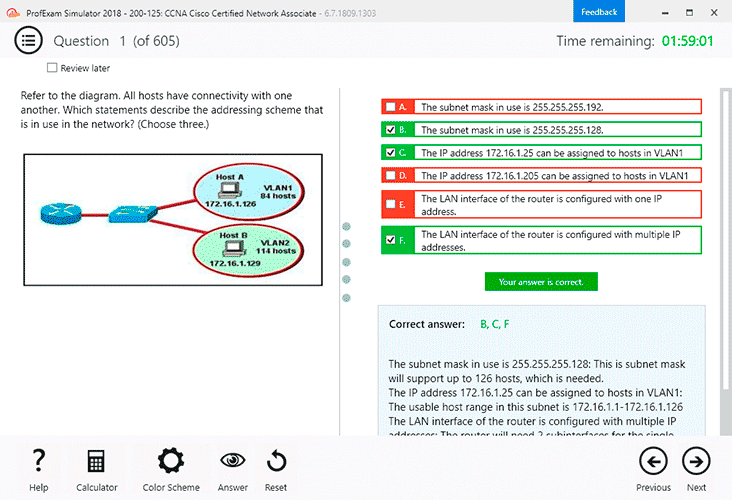

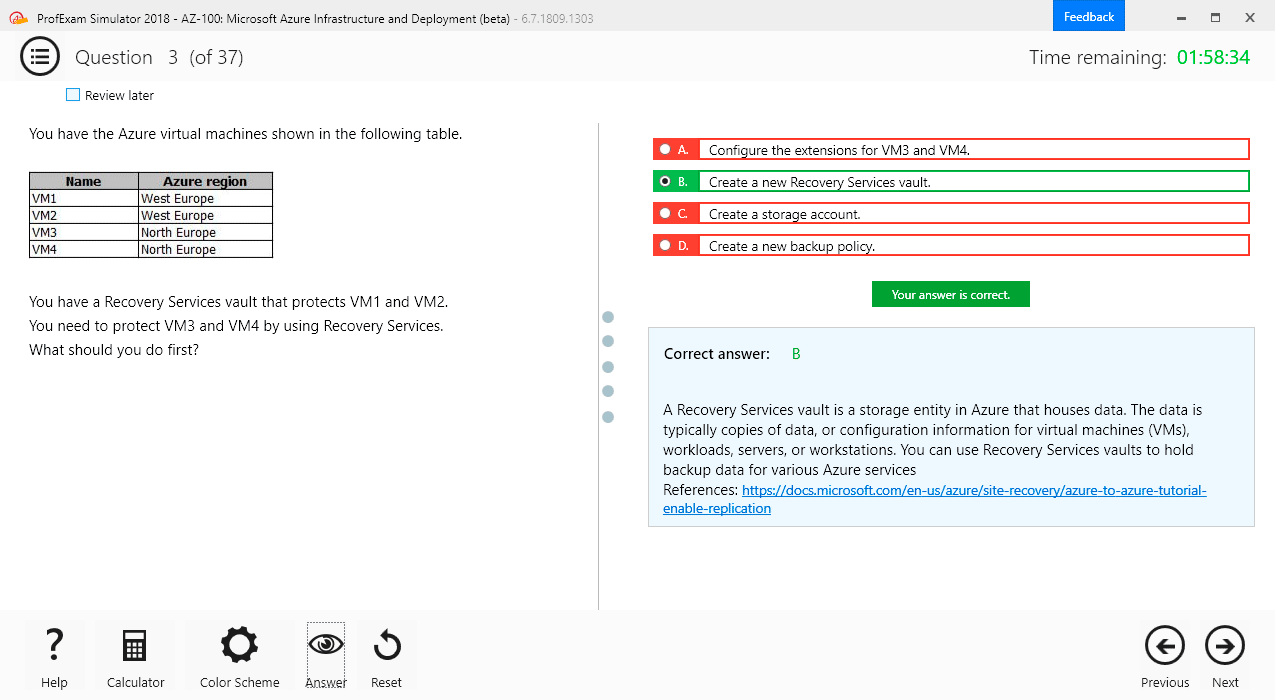

Files with VCEX & EXAM extensions can be opened by ProfExam Simulator.

Coupon: MASTEREXAM

With discount: 20%

Demo Questions

Question 1

You want your expense auditors to audit only expense reports for specific business units. How do you do this?

- Create a custom duty role and assign the data roles to each auditor.

- Create your own audit extension rules that correspond to the business unit.

- Make auditors the managers of the corresponding business unit to route expense reports properly.

- Assign the expense auditors job role and business unit security context and value to the user.

Correct answer: D

Question 2

Which invoice types can be included in the Create Payment flow?

- Standard, Credit Memo and Debit Memo

- Standard, Credit Memo and Customer Refund

- Standard, Credit Memo, and Invoice Request

- Standard, Debit Memo and Customer Refund

Correct answer: A

Question 3

A company has a requirement to default the disbursement bank account when submitting a Payment Process Request.

Which actions will accomplish this? (Choose two.)

- Define the Disbursement Bank Account at the business unit level to have the payment process derive the bank account.

- Define the Disbursement Bank Account to the Payment Method in payment default rules.

- Define the Disbursement Bank Account to every supplier.

- Create a Payment Process Request template that includes the Disbursement Bank Account.

- Assign the Disbursement Bank Account to users to have the payment process default the bank account.

Correct answer: BD

Question 4

Certain suppliers that your customer regularly deals with are exempt from tax. How would you configure tax for this?

- Enable the relevant suppliers for Offset Tax and create an Offset Tax to remove the calculated tax line from these suppliers.

- Define a Tax Status and Rate for Exempt, define a Party Fiscal Classification of Exempt, assign it to the relevant suppliers, and write a rule to incorporate the exempt Party Fiscal Classification.

- Create a new Tax Regime for the Exempt tax and subscribe the exempt suppliers to the tax regime on the Configuration Options tab.

- Define a Tax Status and Rate for Exempt, define a Supplier Fiscal Classification of Exempt, assign it to the relevant suppliers, and write a rule to incorporate the exempt Supplier Fiscal Classification.

Correct answer: A

Question 5

Which method can you use to route payment approval rules?

- Approval Groups

- Sequential

- Both Parallel and Sequential

- Parallel

- Serial and FYI (For Your Information)

Correct answer: A

Question 6

You need to enter a last-minute invoice during the close process. What is the quickest way to enter and post the invoice to general ledger?

- Enter the invoice via a spreadsheet. Then, from the Manage Invoices page, query the invoice, validate it, create accounting, and then open general ledger’s Manage Journals page and post the associated invoice journal entry.

- Enter the invoice in the Create Invoice page, choose the Validate option, and then the Account and Post to Ledger option.

- Enter and post a manual journal entry directly into the general ledger.

- Enter the invoice via a spreadsheet and then validate, account, and post the invoice from the spreadsheet.

Correct answer: A

Question 7

You have invoices with distributions across primary balancing segments that represent different companies.

What feature should you use if you want the system to automatically balance your invoice’s liability amount across the same balancing segments on the invoice distributions?

- Payable’s Automatic Offset

- Intercompany Balancing

- Subledger Accounting’s Account Rules

- Suspense Accounts

- Payables’ Allow Reconciliation Accounting

Correct answer: A

Question 8

When creating a check payment, from where is the payment document defaulted?

- Legal Entity

- Bank

- Business Unit

- Bank Account

- Supplier

Correct answer: D

Question 9

You want to route invoices to three different approvers at the same time and only one approver needs to approve the invoice. Which approval ruleset should you use?

- InvoiceApproversFYIParticipantInParallelMode

- InvoiceApproversSingleParticipantInParallelMode

- InvoiceApproversParallelParticipantInParallelMode

- Invoice Approvers

Correct answer: B

Question 10

An installment meets all the selection criteria of a Payment Process Request, but it still does not get selected for payment processing.

What are the two possible reasons for this? (Choose two.)

- The pay-through date is in a closed Payables period.

- The invoice has not been accounted.

- The invoice requires approval.

- The pay-through date is in a future period.

- The invoice needs re-validation.

Correct answer: CE