File Info

| Exam | JD Edwards EnterpriseOne Financial Management 9.2 Implementation Essentials |

| Number | 1z0-342 |

| File Name | Oracle.1z0-342.Prep4Sure.2019-06-07.38q.vcex |

| Size | 327 KB |

| Posted | Jun 07, 2019 |

| Download | Oracle.1z0-342.Prep4Sure.2019-06-07.38q.vcex |

How to open VCEX & EXAM Files?

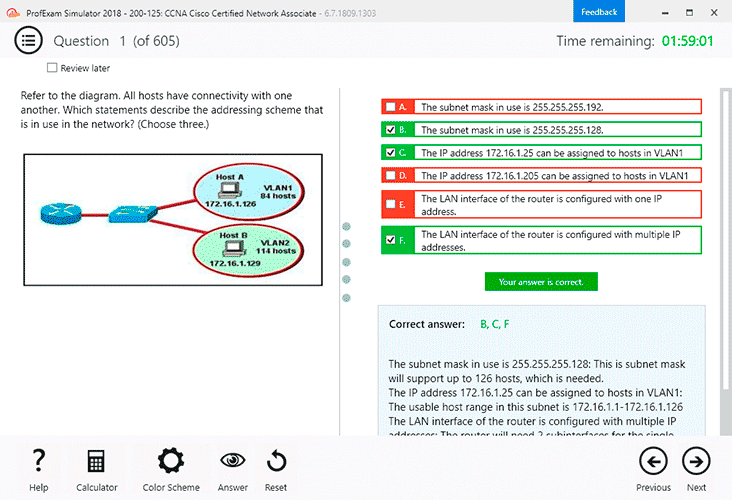

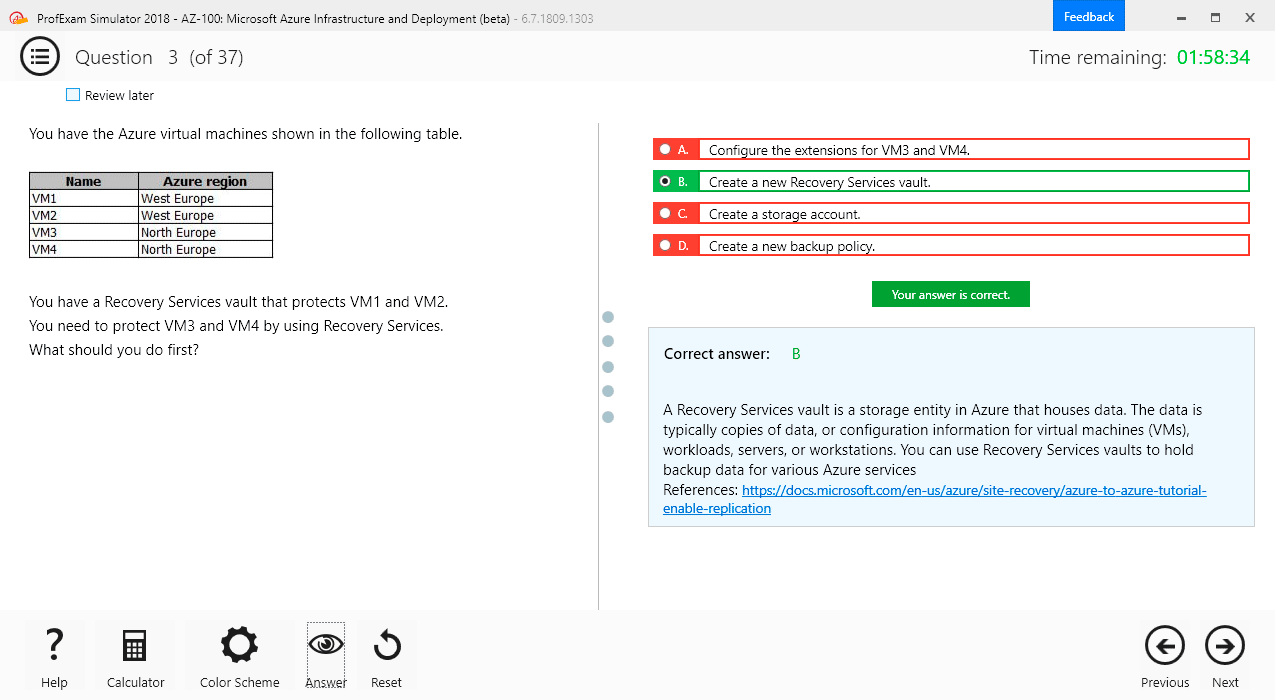

Files with VCEX & EXAM extensions can be opened by ProfExam Simulator.

Coupon: MASTEREXAM

With discount: 20%

Demo Questions

Question 1

Your client is attempting to track taxes for certain voucher pay items; however, the tax information details for the accounts are not being created.

Which two items will you have your client correct? (Choose two.)

- The client is updating the Track Taxes field on the voucher GL Distribution to a value of 2.

- The client is populating the taxable amount field when manually creating vouchers, to track taxes. The gross amount field should be populated to allow thesystem to calculate and trach the taxes.

- The client is using tax explanation codes ST and VT that are only valid for invoices and not vouchers.

- The client is reviewing information in the F0018R table; allocated tax amounts from the F0911 reside in the F0018 table.

- The general ledger accounts input on the GL Distribution form are not set up as taxable.

Correct answer: AC

Question 2

Which field or fields make up the unique key(s) that link the Receipt Header table (F03B13) to the Receipt Detail (F03B14) table?

- G/L Date (DGJ) Receipt Number (CKNU) and Company (CO)

- Receipt Number (CKNU)

- Payment ID (PYID)

- Payment ID (PYID) and Receipt Number (CKNU)

- Receipt Number (CKNU) and Address Number (AN8)

Correct answer: A

Explanation:

Question 3

Which program must be run to create sales invoices in the Accounts Receivable system?

- the Invoice Print program (R03B305)

- the Sales Update program (R42800)

- the Invoice Generation program (R48121)

- the Invoice Journal program (R03B305)

Correct answer: B

Explanation:

Reference: http://learn-jde.com/understanding-sales-order-invoices/ Reference: http://learn-jde.com/understanding-sales-order-invoices/

Question 4

Although the Automation Rule (ARTL) field is not a required field when populating the F0411Z1 table, why does Oracle recommend populating it?

- If a value exists in the field, the process does not need to check the voucher record for an automation rule increasing the processing speed.

- If a value exists in the field, the process does not need to check the receiver file for an automation rule increasing the processing speed.

- If the Automation Rule (ARTL) field is not populated, the Automation Flag (ATFLG) field is not enabled.

- If a value exists in the field, the process does not need to check the supplier master record for an automation rule increasing the processing speed.

Correct answer: D

Explanation:

Reference: https://docs.oracle.com/cd/E16582_01/doc.91/e15131/understand_auto_vm.htm Reference: https://docs.oracle.com/cd/E16582_01/doc.91/e15131/understand_auto_vm.htm

Question 5

How should you implement credit checking at the parent level?

- Set customer master “Billing Information related address number” to P- Parent number.

- Set customer master “Send Invoice to” Information to P- Parent.

- Set address book “Related Address number” to P- Parent.

- Set customer master “Billing information credit check” to P- Parent.

Correct answer: D

Explanation:

Reference: https://www.jdelist.com/w3tfiles/64349-Credit%20Checking%20and%20Order%20Holds.pdf Reference: https://www.jdelist.com/w3tfiles/64349-Credit%20Checking%20and%20Order%20Holds.pdf

Question 6

Which two statements are true regarding the address book audit log feature? (Choose two.)

- You can set it up to record new records only.

- You can set it up to record new records that have been entered and changes to existing records.

- You can set it up to record changes to existing records.

- It is a user preference.

- You can set it up to record deleted records only.

Correct answer: BC

Explanation:

Reference: https://docs.oracle.com/cd/E16582_01/doc.91/e15078/set_up_addr_book_system.htm#EOAAB00035 Reference: https://docs.oracle.com/cd/E16582_01/doc.91/e15078/set_up_addr_book_system.htm#EOAAB00035

Question 7

Which three statements are accurate when entering the GL Distribution account coding on an invoice with taxes? (Choose three.)

- If the account is not set up as taxable and you enter a 1 in the Track Taxes field, the system automatically changes the value to 0.

- The system updates the F0016R tax table with tax information for the account if the Track Taxes field is populated.

- The system automatically updates the Track Taxes field to 1 if the account is set up as taxable and at least one pay item on the invoice has taxes.

- If you do not want to track taxes for the account, change the value in the Track Taxes field to 0.

- The Track Taxes field cannot be edited unless the Processing Option – Allow Tax Tracking is flagged on.

Correct answer: ACD

Explanation:

Reference: https://docs.oracle.com/cd/E16582_01/doc.91/e15153/taxinfo_on_order_transactns.htm#EOATP00198 Reference: https://docs.oracle.com/cd/E16582_01/doc.91/e15153/taxinfo_on_order_transactns.htm#EOATP00198

Question 8

Which option shows the correct steps for processing automatic payments?

- Create payment groups, Copy bank tape file, Work with payment group, and Void payments and vouchers

- Create payment groups, Work with payment group, Copy bank tape file, and Void payments and vouchers

- Create payment groups, Copy bank tape file, and Void payments and vouchers

- Create payment groups, Void payments and vouchers, Work with payment group, and Copy bank tape file

Correct answer: A

Explanation:

Reference: http://learn-jde.com/understanding-automatic-payment-processes/ Reference: http://learn-jde.com/understanding-automatic-payment-processes/

Question 9

Your client has decided to use journal entries to create budgets in the system. After journaling the budgets, they have found the records in the F0911 table but cannot locate the balance in the F0902 table.

Where are the balance records contained in the F0902?

- Similar to directly entering budgets into the system, the budgets balances can be found in the BREQ, BAPR, and BORG fields depending on the processing options set for the journal entry program.

- Journalized budgets are located in the Budget Requested field (BREQ).

- Journalized budgets are located in the Budget Approved field (BARP).

- Budget entries created from a journal entry do not update BREQ, BAPR, or BORG. They update the Net Posting fields for the appropriate periods in the F0902 table.

- Budgets entries created from a journal entry do not update the Account Balance (F0902) table; you must utilize the Account Ledger (F0911) to review and report on budgets.

- Journalized budgets only update the Budget Final field (BORG).

Correct answer: D

Explanation:

Reference: https://docs.oracle.com/cd/E16582_01/doc.91/e15112/createbudgets.htm#EOAGA01088 Reference: https://docs.oracle.com/cd/E16582_01/doc.91/e15112/createbudgets.htm#EOAGA01088

Question 10

Your client has posted a fixed asset journal entry to the G/L but is getting errors when trying to post the entry to fixed assets.

Which two statements correctly indicate reasons for the entry not getting posted? (Choose two.)

- The entry has a fixed asset post code of P.

- The entry has a hold code of blank.

- The entry has a GL post code of P.

- The entry contains accounts within the FX range of AAIs.

- The entry does not contain an asset number.

Correct answer: AE

Explanation:

Reference: https://docs.oracle.com/cd/E16582_01/doc.91/e15107/proc_gl_to_fixed_assets.htm#EOAFA00276 Reference: https://docs.oracle.com/cd/E16582_01/doc.91/e15107/proc_gl_to_fixed_assets.htm#EOAFA00276