File Info

| Exam | Oracle E-Business Suite R12 Project Essentials |

| Number | 1z0-511 |

| File Name | Oracle.1z0-511.CertKey.2019-02-26.80q.vcex |

| Size | 432 KB |

| Posted | Feb 26, 2019 |

| Download | Oracle.1z0-511.CertKey.2019-02-26.80q.vcex |

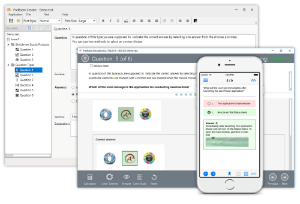

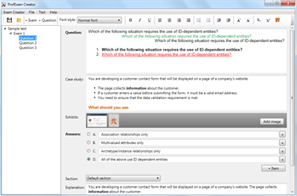

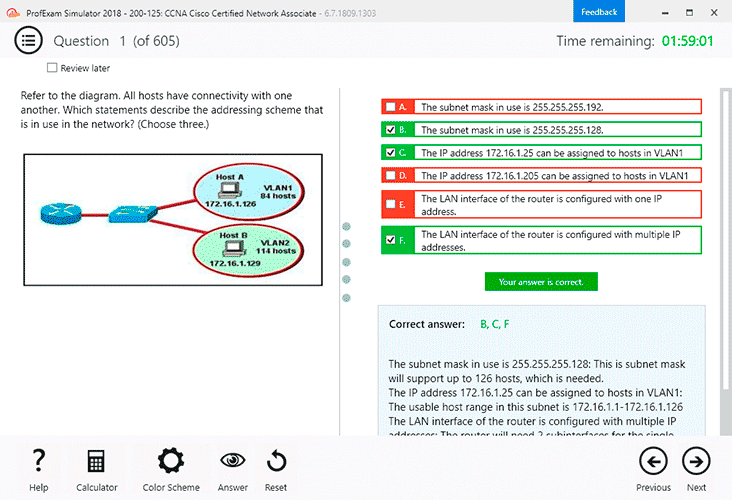

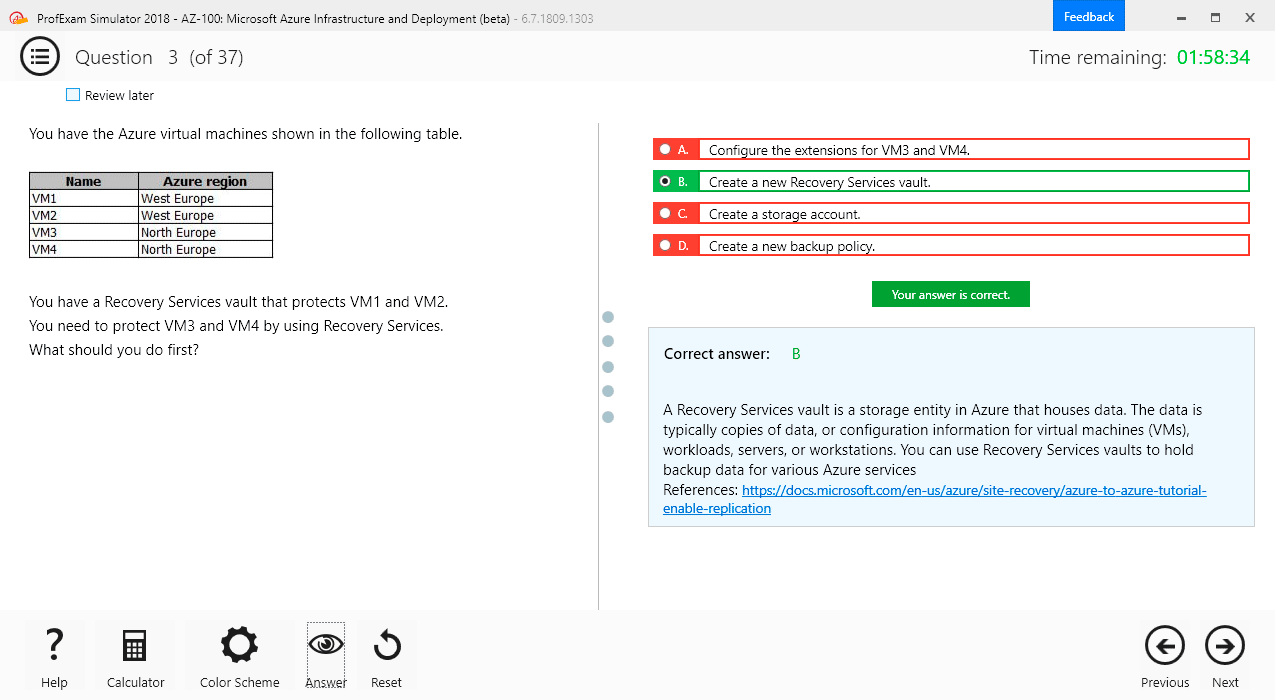

How to open VCEX & EXAM Files?

Files with VCEX & EXAM extensions can be opened by ProfExam Simulator.

Coupon: MASTEREXAM

With discount: 20%

Demo Questions

Question 1

Your customer has set up a contract project with a distribution rule Work/Work. Identify three setup options to:

- Charge labor transactions revenue and all other nonlabor transactions revenue to separate account

- Generate separate invoice line amounts for labor and nonlabor transactions

- Setup revenue categories as required.

- Define revenue accounts at the revenue category setup level.

- Define AutoAccounting rules to derive revenue account based on revenue category.

- Define grouping option by revenue category on the invoice format and attach the invoice format at the project type level.

- Define grouping option by revenue category on the project type.

Correct answer: ACD

Explanation:

Note:Revenue and Billing Information When you enter revenue information for your project, you specify a revenue distribution rule for the revenue accrual method and the billing method for this project. When you enter billing information, you specify invoice formats, bill cycle days, and other invoicing information. The project type determines which revenue distribution rule appears as the default value for this field, and which other revenue distribution rules you can choose from. Oracle Projects predefines the following revenue distribution rules:Cost/CostAccrue revenue and bill using the ratio of actual cost to budgeted cost (percent spent). Cost/EventAccrue revenue using the ratio of actual cost to budgeted cost (percent spent), and bill based on events. Cost/WorkAccrue revenue using the ratio of actual cost to budgeted cost (percent spent), and bill as work occurs. Event/EventAccrue revenue and bill based on events. Event/WorkAccrue revenue based on events, and bill as work occurs. Work/EventAccrue revenue as work occurs, and bill based on events. Work/WorkAccrue revenue and bill as work occurs. Note:

Revenue and Billing Information

When you enter revenue information for your project, you specify a revenue distribution rule for the revenue accrual method and the billing method for this project. When you enter billing information, you specify invoice formats, bill cycle days, and other invoicing information.

The project type determines which revenue distribution rule appears as the default value for this field, and which other revenue distribution rules you can choose from. Oracle Projects predefines the following revenue distribution rules:

Cost/CostAccrue revenue and bill using the ratio of actual cost to budgeted cost (percent spent).

Cost/EventAccrue revenue using the ratio of actual cost to budgeted cost (percent spent), and bill based on events.

Cost/WorkAccrue revenue using the ratio of actual cost to budgeted cost (percent spent), and bill as work occurs.

Event/EventAccrue revenue and bill based on events.

Event/WorkAccrue revenue based on events, and bill as work occurs.

Work/EventAccrue revenue as work occurs, and bill based on events.

Work/WorkAccrue revenue and bill as work occurs.

Question 2

Identify two predefined transaction sources that Oracle Projects uses to import the transactions generated within Oracle Projects.

- Oracle Interproject Supplier Invoices

- Oracle Projects Intercompany Supplier Invoices

- Project Allocations

- Capitalized Interest

- Oracle Interprojed Customer Invoices

Correct answer: CD

Explanation:

Oracle Projects uses predefined transaction sources to import project allocations and capitalized interest transactions that it generates internally. Oracle Projects uses predefined transaction sources to import project allocations and capitalized interest transactions that it generates internally.

Question 3

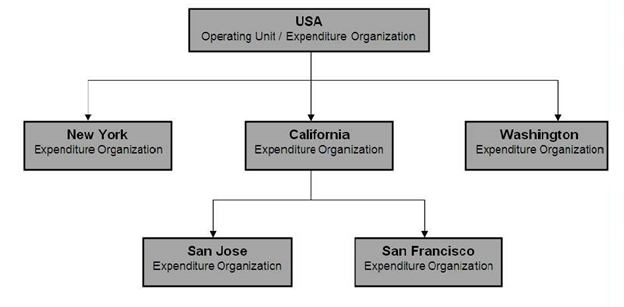

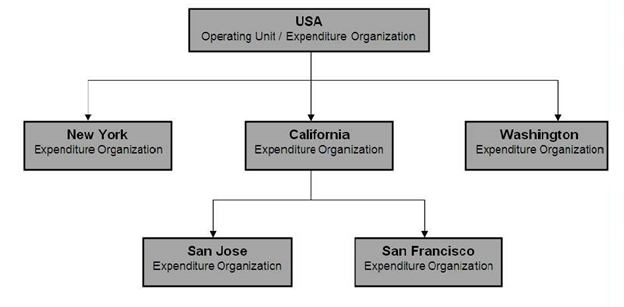

Refer to the exhibit.

In your company's Expenditure/Event Organization Hierarchy, organization labor costing rules are assigned to all organizations except San Jose. What happens when you run the "PRC: Distribute labor costs" program for a timecard transaction entered by an employee from the San Jose organization?

- The rule assigned for San Francisco takes precedence and the transaction will he successfully a distributed.

- The rule assigned for USA takes precedence and the transaction will he successfully cost distributed.

- The rule assigned for California takes precedence and the transaction will be successfully cost distributed.

- The program ignores this transaction, because no labor costing rule is assigned for San Jose and completes normally.

- The program completes normally. However, the output will have this transaction under the exceptions section with a message "No Labor costing rule assigned for organization."

Correct answer: C

Question 4

Which two options are not task attributes for financial task structure?

- Task Type

- Service Type

- Work Type

- Chargeable Flag

- Scheduled Dates

Correct answer: BD

Explanation:

Incorrect:Not A: Task types assign default attributes to tasks and control how Oracle Projects processes tasks. Task types specify basic task attributes.Not C: Work types represent a classification of work. You use work types to classify both actual and scheduled work.Not E: Oracle Projects uses start and finish dates to control processing, indicate estimated and scheduled duration, and serve as tools to evaluate project performance.The start and finish dates at the project level are:Actual: Actual dates when work on the project started and finished. You can use these dates to drive future timecard and earned value functionality.(not E) Scheduled: Scheduled start and finish dates for the project.Target: The expected lifespan of the project.Estimated: A task manager's estimate of when work on the project will be started and finished.Baseline: The baselined schedule Incorrect:

Not A: Task types assign default attributes to tasks and control how Oracle Projects processes tasks. Task types specify basic task attributes.

Not C: Work types represent a classification of work. You use work types to classify both actual and scheduled work.

Not E: Oracle Projects uses start and finish dates to control processing, indicate estimated and scheduled duration, and serve as tools to evaluate project performance.

The start and finish dates at the project level are:

Actual: Actual dates when work on the project started and finished. You can use these dates to drive future timecard and earned value functionality.

(not E) Scheduled: Scheduled start and finish dates for the project.

Target: The expected lifespan of the project.

Estimated: A task manager's estimate of when work on the project will be started and finished.

Baseline: The baselined schedule

Question 5

A new contract project is created for work for a customer by using event-based billing. A decision has been made to give a discount to the customer on a particular invoice. You want to apply this discount and reduce the invoice without affecting revenue.

Which event type should be used to achieve this?

- Manual

- Invoice Reduction

- Deferred Revenue

- Automatic

- Scheduled Payment

Correct answer: D

Explanation:

Event Type Classification is: Scheduled Payment, Deferred Revenue, Invoice Reduction, Manual, or Automatic (for billing events only) Event Type Classification is: Scheduled Payment, Deferred Revenue, Invoice Reduction, Manual, or Automatic (for billing events only)

Question 6

In which two circumstances would it be appropriate to deselect the "Interface Revenue to GL" option in System Implementation Options, before you run the Interface to GL?

- During data migration if Revenue is already in General Ledger

- When Revenue is handled in Accounts Receivable

- When AutoAccounting is incorrect and the Revenue interfacing to General Ledger needs to be put on hold.

- When Finance wants to reconcile Unbilled Receivables/Unearned Revenue

- When Revenue was generated in error for all projects in Released status, and needs to be corrected.

Correct answer: AB

Explanation:

A: If the revenue amounts are already interfaced to General Ledger (GL) through a different interface, then uncheck the ‘Interface Revenue to GL’ option in the implementation options and run the ‘Interface Revenue to GL’ process in Oracle projects. This will turn the flags in the revenue records as accepted in GL, though it is not interfaced. Once this is done, revert back the implementation option back to its original state. A: If the revenue amounts are already interfaced to General Ledger (GL) through a different interface, then uncheck the ‘Interface Revenue to GL’ option in the implementation options and run the ‘Interface Revenue to GL’ process in Oracle projects. This will turn the flags in the revenue records as accepted in GL, though it is not interfaced. Once this is done, revert back the implementation option back to its original state.

Question 7

What type of project will a company require to use Organization Forecasting?

- contract project

- Administration Project

- Organization Planning Project

- capital project

- multi-function project

Correct answer: A

Explanation:

Note:*Compute Forecast Labor Revenue This process calculates the potential revenue of labor expenditure items based on established bill rates and markups. The expenditure items that the process selects are billable labor expenditure items charged to contract projects that have not yet been processed by the Generate Draft Revenue process. The items do not have to be approved to be processed for forecast revenue. Note:

*Compute Forecast Labor Revenue

This process calculates the potential revenue of labor expenditure items based on established bill rates and markups. The expenditure items that the process selects are billable labor expenditure items charged to contract projects that have not yet been processed by the Generate Draft Revenue process. The items do not have to be approved to be processed for forecast revenue.

Question 8

An organization uses Oracle Projects and has fully installed Oracle Human Resources. Which statement does not apply to this scenario?

- Employees can be entered and maintained in Oracle Projects.

- Jobs can be setup in Oracle Projects.

- Organizations can be defined in Oracle Projects.

- Organization Hierarchies can be defined in Oracle Projects.

- Worker Assignments can be viewed in Oracle Projects.

Correct answer: D

Explanation:

Note:*Oracle Projects fully integrates with Oracle Human Resources to keep track of employees and information relevant to them, such as bill rates and mailing address. Note:

*Oracle Projects fully integrates with Oracle Human Resources to keep track of employees and information relevant to them, such as bill rates and mailing address.

Question 9

Identify the four different levels where transaction controls are defined.

- Expenditure Categories

- Expenditure Organization

- Employee

- Project Organization

- Expenditure Type

- Person Type

Correct answer: ACDE

Explanation:

You can configure transaction controls by the following:(A)Expenditure Category (C)Employee (E)Expenditure Type Non-Labor Resource You can configure transaction controls by the following:

(A)Expenditure Category

(C)Employee

(E)Expenditure Type

Non-Labor Resource

Question 10

Your client has expressed a desire to produce and summarize invoice lines for Non-Labor transactions by type of expenditure based on high level tasks of the project.

Which invoice formal grouping should he used to achieve this?

- TopTask, Expenditure Type

- TopTask, Employee

- Revenue Category, Expenditure Category, Top Task

- TopTask, Expenditure Category

- TopTask, Revenue Category, Expenditure Category, Expenditure Type

Correct answer: A

Explanation:

Note:*Oracle Projects processes tasks based on their position in the structure. The three distinct positions are:Top Task: A task whose parent is the projectMid Task: A task that is not a top task or a lowest taskLowest Task: A task that is at the bottom of the structure, without any child tasks*You can configure transaction controls by the following:Expenditure Category Employee Expenditure Type Non-Labor Resource Note:

*Oracle Projects processes tasks based on their position in the structure. The three distinct positions are:

Top Task: A task whose parent is the project

Mid Task: A task that is not a top task or a lowest task

Lowest Task: A task that is at the bottom of the structure, without any child tasks

*You can configure transaction controls by the following:

- Expenditure Category

- Employee

- Expenditure Type

- Non-Labor Resource