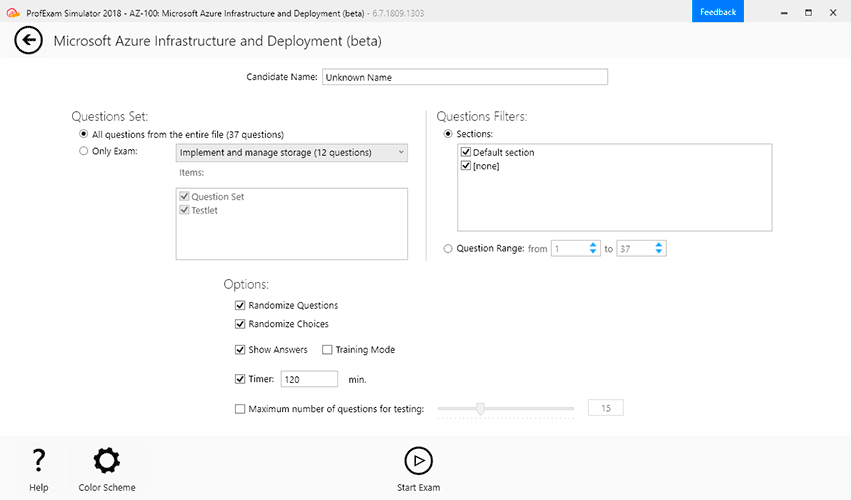

File Info

| Exam | Oracle E-Business Suite R12 Project Essentials |

| Number | 1z0-511 |

| File Name | Oracle.1z0-511.TestKing.2018-06-13.40q.tqb |

| Size | 343 KB |

| Posted | Jun 13, 2018 |

| Download | Oracle.1z0-511.TestKing.2018-06-13.40q.tqb |

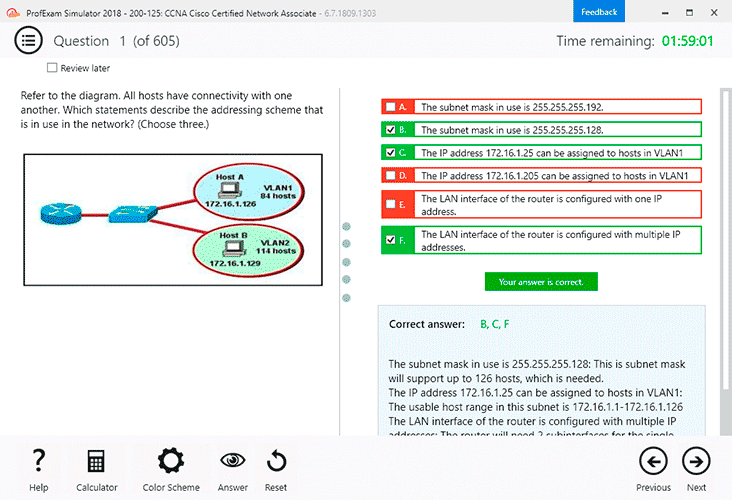

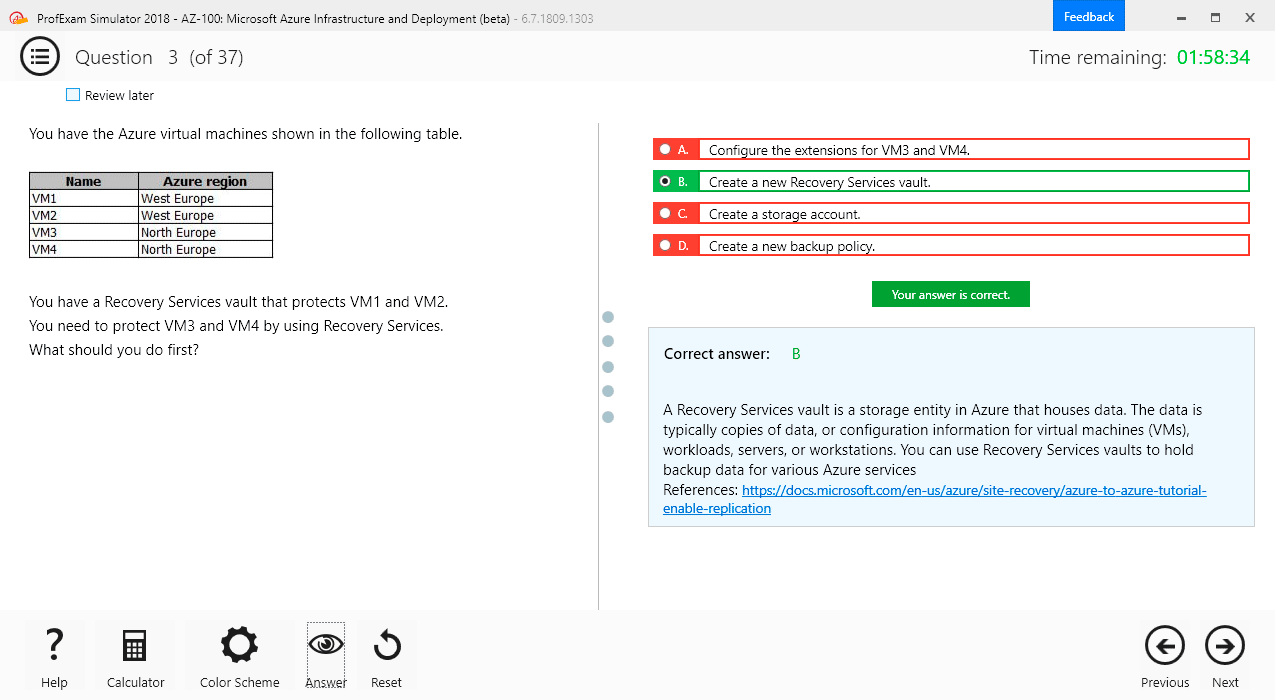

How to open VCEX & EXAM Files?

Files with VCEX & EXAM extensions can be opened by ProfExam Simulator.

Coupon: MASTEREXAM

With discount: 20%

Demo Questions

Question 1

A project is enabled for Burdening by setting up a burden schedule at the project type level. A Miscellaneous expenditure Item Is charged to the project with a raw cost of $100 and expenditure type "Overhead." The "Overheads" expenditure type is excluded from all cost bases in the burden structure.

What happens when the "PRC: Distribute usage and Miscellaneous Costs" program is run for this project?

- The program errors with the message "Missing Expenditure type."

- The program completes successfully; Raw Cost = $100, Burden Cost=$0, Total Burdened cost=$100.

- The program completes successfully; Raw Cost=$100, Burden Cost= $100, Total Burdened cost=$100.

- The program completes successfully; Raw Cost =$100, Burden Cost=$0, Total Burdened cost= $0.

Correct answer: C

Explanation:

Note:*Distribute Usage and Miscellaneous Costs The process computes the costs and determines the default GL account to which to post the cost for expenditure items with the following expenditure type classes:Usages Burden Transactions Miscellaneous Transactions Inventory and WIP transactions not already costed or accounted Note:

*Distribute Usage and Miscellaneous Costs

The process computes the costs and determines the default GL account to which to post the cost for expenditure items with the following expenditure type classes:

Usages

Burden Transactions

Miscellaneous Transactions

Inventory and WIP transactions not already costed or accounted

Question 2

A customer wants to make a new classification mandatory on all their new projects. Select the three options that could help them accomplish this.

- Define the classification as Mandatory in the Classification configuration.

- Define the classification as Mandatory in the Project Type configuration.

- Define the classification category to allow one code only.

- Define project status controls to disallow project status changes where classification category codes are missing.

- Define the classification as Required on the appropriate project templates in the QuickEntry screen.

Correct answer: A

Explanation:

Note:*You define project classifications to group your projects according to categories you define. A project classification includes a class category and a class code. The category is a broad subject within which you can classify projects. The code is a specific value of the category. *(see step 3 below) Defining class categories and class codes To define class categories and class codes:1.Navigate to the Class Categories and Codes window. 2.Enter a unique Class Category name and a Description. 3.Specify whether the class category is mandatory for every project you define. Enable if all projects must have a code assigned to this class category. Do not enable if this class category is optional. If you do not enable this option, you cannot use this class category in your AutoAccounting rules. 4.Specify whether you want to use the class category in your AutoAccounting rules. Suggestion: For each project, you can use only one code with one class category for use with AutoAccounting rules. If an AutoAccounting category already exists within a particular date range, assign an end date to the existing AutoAccounting category and then create a new one.5.Specify whether you want to allow entry of only one class code with this class category for a project. Note: Defining multiple class codes for one category for a project may affect reporting by class category; defining multiple class codes may cause your numbers to be included more than once.6.Enter the Name, Description, and Effective Dates for each class code. 7.Save your work. References: Note:

*You define project classifications to group your projects according to categories you define. A project classification includes a class category and a class code. The category is a broad subject within which you can classify projects. The code is a specific value of the category.

*(see step 3 below) Defining class categories and class codes

To define class categories and class codes:

1.Navigate to the Class Categories and Codes window.

2.Enter a unique Class Category name and a Description.

3.Specify whether the class category is mandatory for every project you define.

Enable if all projects must have a code assigned to this class category. Do not enable if this class category is optional. If you do not enable this option, you cannot use this class category in your AutoAccounting rules.

4.Specify whether you want to use the class category in your AutoAccounting rules.

Suggestion: For each project, you can use only one code with one class category for use with AutoAccounting rules. If an AutoAccounting category already exists within a particular date range, assign an end date to the existing AutoAccounting category and then create a new one.

5.Specify whether you want to allow entry of only one class code with this class category for a project.

Note: Defining multiple class codes for one category for a project may affect reporting by class category; defining multiple class codes may cause your numbers to be included more than once.

6.Enter the Name, Description, and Effective Dates for each class code.

7.Save your work.

References:

Question 3

An employee has entered eight hours of billable time on a project. You want only three hours to be billable and five hours to be nonbillable. What is the adjustment action that should be applied on this expenditure item?

- Transfer the item.

- Change the billable status.

- Split the item.

- Apply billing hold.

- Change quantity.

Correct answer: C

Explanation:

You can split an item into two items so that you can process the two resulting split items differently. For example, you may have an item for 10 hours, of which you want 6 hours to be billable and 4 hours to be non-billable. You would split the item of 10 hours into two items of 6 hours and 4 hours, marking the 6 hours to be billable and 4 hours to be non-billable. The resulting split items are charged to the same project and task as the original item. References: You can split an item into two items so that you can process the two resulting split items differently.

For example, you may have an item for 10 hours, of which you want 6 hours to be billable and 4 hours to be non-billable. You would split the item of 10 hours into two items of 6 hours and 4 hours, marking the 6 hours to be billable and 4 hours to be non-billable.

The resulting split items are charged to the same project and task as the original item.

References: