File Info

| Exam | Oracle Financials Cloud: Payables 2017 Implementation Essentials |

| Number | 1z0-961 |

| File Name | Oracle.1z0-961.PassGuide.2017-12-04.73q.tqb |

| Size | 286 KB |

| Posted | Dec 04, 2017 |

| Download | Oracle.1z0-961.PassGuide.2017-12-04.73q.tqb |

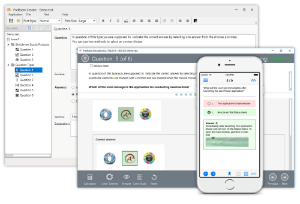

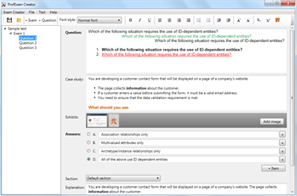

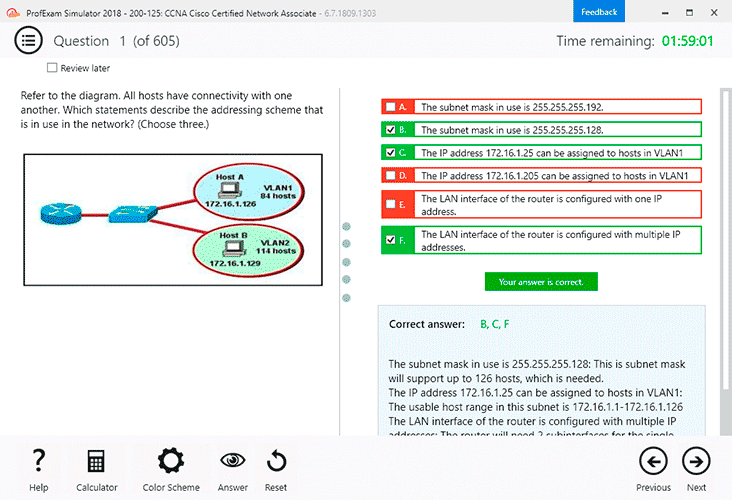

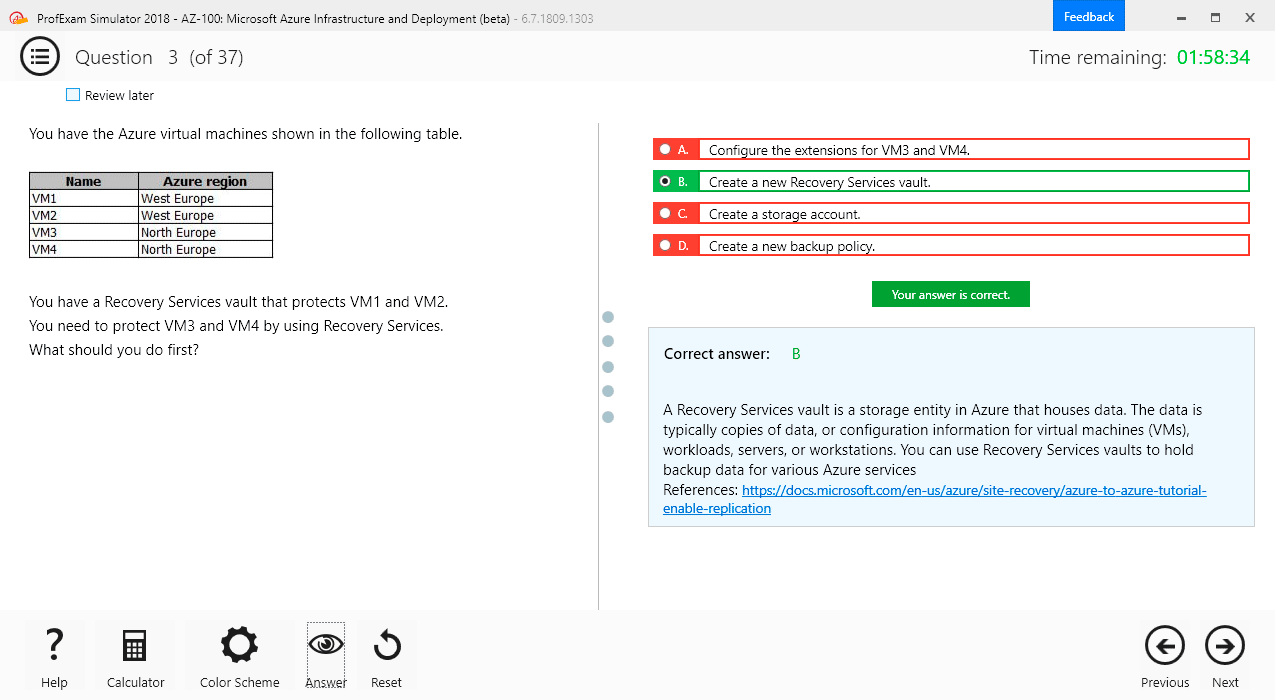

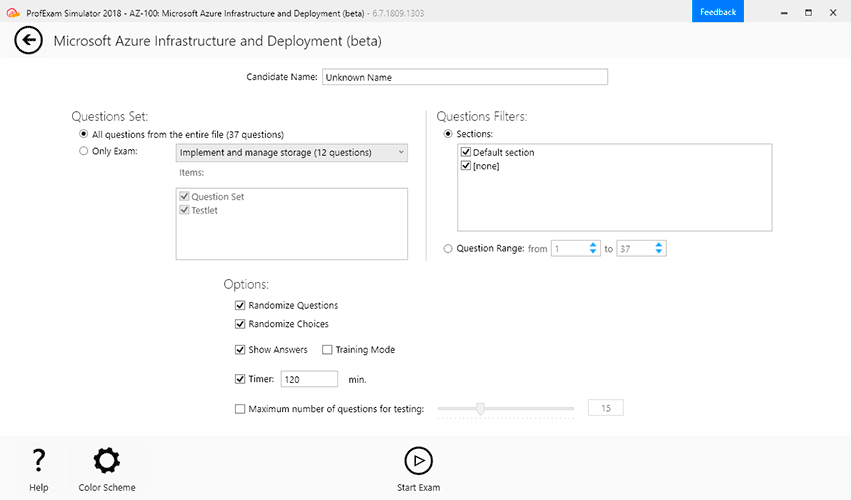

How to open VCEX & EXAM Files?

Files with VCEX & EXAM extensions can be opened by ProfExam Simulator.

Coupon: MASTEREXAM

With discount: 20%

Demo Questions

Question 1

An installment meets all of the selection criteria of a Payment Process Request but it still did not get selected for payment processing. Identify two reasons for this.

- The installment was manually removed.

- The invoice has not been accounted.

- The pay-through date is in a future period.

- The pay-through date is in a closed Payables period.

- The invoices need revalidation.

Correct answer: AE

Explanation:

Reference https://docs.oracle.com/cd/E37017_01/doc.1115/e22897/F438410AN16238.htm Reference https://docs.oracle.com/cd/E37017_01/doc.1115/e22897/F438410AN16238.htm

Question 2

You are using the Payable’s Deferred Expense feature (also known as Multiperiod Accounting). You have entered an invoice for a three-month lease that is entered on Jan 10th. The total expense is $12,000 and it covers the rental period from Jan 1st to mar 31st.

Assuming that the rental expenses are split evenly per month and a monthly accounting calendar is used, what would the accounting entry be?

- On Jan 10th, Debit Prepaid Expense 12,000 and Credit Liability for 12,000and thenOn Jan 31st, Debit Rental Expense for 4,000 and Credit Prepaid Expense for 4,000On Feb 28st, Debit Rental Expense for 4,000 and Credit Prepaid Expense for 4,000On Mar 31st, Debit Rental Expense for 4,000 and Credit Prepaid Expense for 4,000

- On Jan 10th, Debit Prepaid Expense 12,000 and Credit Liability for 12,000

- On Jan 31st, Debit Rental Expense for 4,000 and Credit Prepaid Expense for 4,000On Feb 28st, Debit Rental Expense for 4,000 and Credit Prepaid Expense for 4,000

- On Mar 31st, Debit Rental Expense for 4,000 and Credit Prepaid Expense for 4,000On Jan 10th, Debit Prepaid Expense 12,000 and Credit Liability for 12,000

Correct answer: A

Question 3

Which statement is correct if the payment terms entered in the invoice differ from the payment terms on the purchase order?

- The purchase order payment term cannot be overridden.

- The user needs to manually change the payment term on the invoice to match the purchase order payment term.

- The user needs to specify which payment term to use.

- The payment term of the invoice overrides the purchase order payment term.

- The payment term of the purchase order overrides the invoice payment term.

Correct answer: B