File Info

| Exam | Oracle Payroll Cloud 2017 Implementation Essentials |

| Number | 1z0-969 |

| File Name | Oracle.1z0-969.PracticeTest.2018-07-24.39q.vcex |

| Size | 27 KB |

| Posted | Jul 24, 2018 |

| Download | Oracle.1z0-969.PracticeTest.2018-07-24.39q.vcex |

How to open VCEX & EXAM Files?

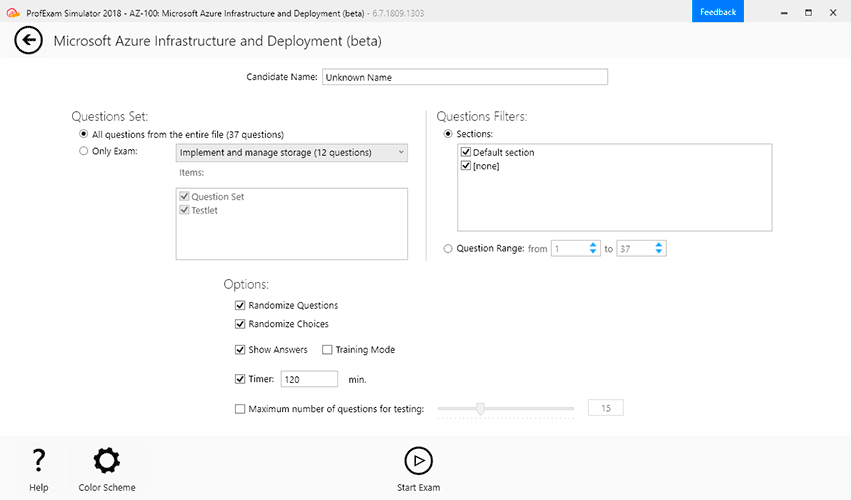

Files with VCEX & EXAM extensions can be opened by ProfExam Simulator.

Coupon: MASTEREXAM

With discount: 20%

Demo Questions

Question 1

You need to enter bank account details for the employees within your company. Which task should you use to do this?

- Manage Third-Party Person Payment Methods

- Manage Personal Payment Methods

- Manage Element Entries

- Manage Organization Payment Methods

Correct answer: B

Explanation:

Reference: https://docs.oracle.com/cd/E60665_01/globalcs_gs/FAGPI/FAGPI1655659.htm#FAGPI796898 Reference: https://docs.oracle.com/cd/E60665_01/globalcs_gs/FAGPI/FAGPI1655659.htm#FAGPI796898

Question 2

You are currently reconciling a payroll run and are informed of a late starter who you would like included in the payments part of the main processing flow.

Which feature should you use to achieve this?

- Connecting Flows

- Calling a Flow

- Flow Linkage

- Flow Interaction

Correct answer: D

Explanation:

Reference: https://docs.oracle.com/cd/E60665_01/globalcs_gs/OAPAY/F1427133AN1BE47.htm Reference: https://docs.oracle.com/cd/E60665_01/globalcs_gs/OAPAY/F1427133AN1BE47.htm

Question 3

Which two statements regarding the relationship between legal entities, legal employers, and payroll statutory units (PSU) are correct? (Choose two.)

- A legal employer can be associated with multiple PSUs.

- PSUs are legal entities responsible for payroll tax and social insurance reporting.

- Legal employers are legal entities responsible for paying workers.

- A legal entity cannot be both a legal employee and a PSU.

Correct answer: BC

Explanation:

Reference: https://docs.oracle.com/en/cloud/saas/financials/r13-update17d/faigl/legal-entities.html#FAIGL1453110 Reference: https://docs.oracle.com/en/cloud/saas/financials/r13-update17d/faigl/legal-entities.html#FAIGL1453110

Question 4

Where would a payroll flow task retrieve its parameter information when selecting “Bind to Flow Task Parameter”?

- Derives the value from a SQL Bind

- Derives the value from the output of the previous task

- Derives the value from the context of the current flow instance

- Derives a specific value to the parameter as entered by the user

Correct answer: B

Explanation:

Reference: https://docs.oracle.com/en/cloud/saas/global-human-resources/r13-update17d/faigp/setting-up-payroll-flow-patterns.html#FAIGP2317488 Reference: https://docs.oracle.com/en/cloud/saas/global-human-resources/r13-update17d/faigp/setting-up-payroll-flow-patterns.html#FAIGP2317488

Question 5

What three options should be considered while defining a costing key flexfield structure? (Choose three.)

- Value sets for the segments

- Cost hierarchy levels enabled to populate each cost account segment

- segments required for the offset account

- GL Accounting key flexfield structure

Correct answer: ABC

Explanation:

Reference: https://docs.oracle.com/cd/E51367_01/globalop_gs/FAIGP/F1427204AN1E085.htm Reference: https://docs.oracle.com/cd/E51367_01/globalop_gs/FAIGP/F1427204AN1E085.htm

Question 6

How can you delete a payroll flow pattern that has not been previously submitted?

- Change the status of the flow pattern to be “Inactive” in Manage Flow Patterns. Then select “Delete” from the actions menu.

- Ensure all tasks are deleted and then from Manage Payroll Flow Patterns task, search for your flow and select “Delete” from the actions menu.

- You cannot delete flow patterns.

- From Manage Payroll Flow Patterns task, search for your flow and select Delete” from the actions menu.

Correct answer: D

Question 7

You have run payroll process and need to validate and audit the run results before moving on to processing the payment. Which report helps you in diagnosing the results?

- Payroll Data Validation Report

- Payroll Balance Report

- Balance Exception Report

- Payroll Activity Report

Correct answer: D

Explanation:

Reference: https://docs.oracle.com/en/cloud/saas/global-human-resources/r13-update17d/oapay/calculate-validate-and-balance-payroll.html#OAPAY775957https://docs.oracle.com/en/cloud/saas/global-human-resources/r13-update17d/oapay/calculate-validate-and-balance-payroll.html Reference: https://docs.oracle.com/en/cloud/saas/global-human-resources/r13-update17d/oapay/calculate-validate-and-balance-payroll.html#OAPAY775957https://docs.oracle.com/en/cloud/saas/global-human-resources/r13-update17d/oapay/calculate-validate-and-balance-payroll.html

Question 8

You are creating a custom balance that needs to include run results of all elements associated with the regular earnings and supplemental earnings classifications.

How should you define the balance feeds to meet this requirement?

- Create balance feeds for each element belonging to regular earnings and supplemental earnings classifications.

- This requirement cannot be met because a balance cannot be fed by elements from more than one element classification.

- Create a balance feed for the regular earnings classification and a balance feed for the supplemental earnings classification.

- Create balance feeds for each element belonging to regular earnings and supplemental earnings classifications but ensure the number of feeds does not exceed 250.

Correct answer: C

Question 9

A worker moves to a different legal employer within the same country. The HR uses performs a global transfer to meet this requirement.

What is the impact of the transfer on the worker’s payroll relationship record?

- The payroll relationship will be ended and a new relationship is created.

- There is no impact.

- It depends on the customer’s payroll statutory unit and legal employer structure.

- It depends on the customer’s payroll statutory unit and tax reporting structure.

Correct answer: C

Question 10

When defining your customer’s monthly payroll, they ask you to set the cut-off date for their monthly payroll to five days before the period end date.

What is the impact of the cut-off date on payroll processing?

- The cut-off date triggers the automatic submission of the payroll calculation

- The cut-off date is for informational purposes only.

- The application restricts HR users from entering data after the payroll cut-off date.

- The application restricts Payroll users from entering data after the payroll cut-off date.

Correct answer: D