File Info

| Exam | SAP Certified Associate-SAP S-4HANA Cloud Private Edition-Treasury |

| Number | C_S4FTR_2023 |

| File Name | SAP.C_S4FTR_2023.VCEplus.2024-11-08.33q.tqb |

| Size | 125 KB |

| Posted | Nov 08, 2024 |

| Download | SAP.C_S4FTR_2023.VCEplus.2024-11-08.33q.tqb |

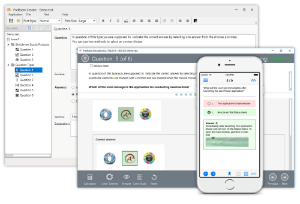

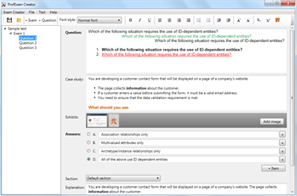

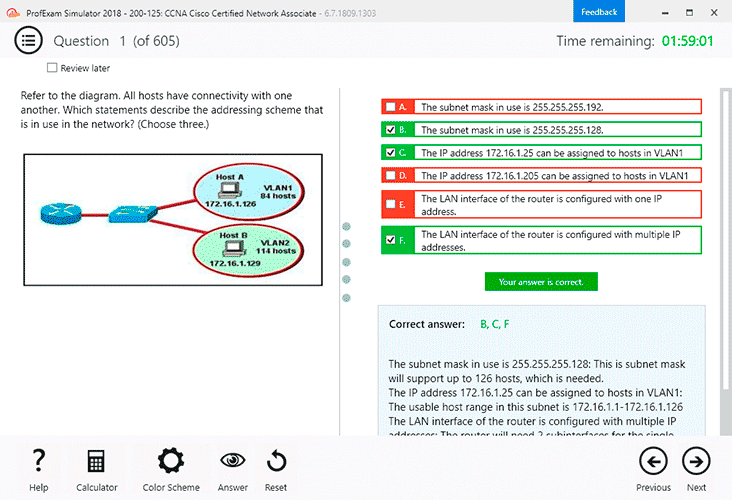

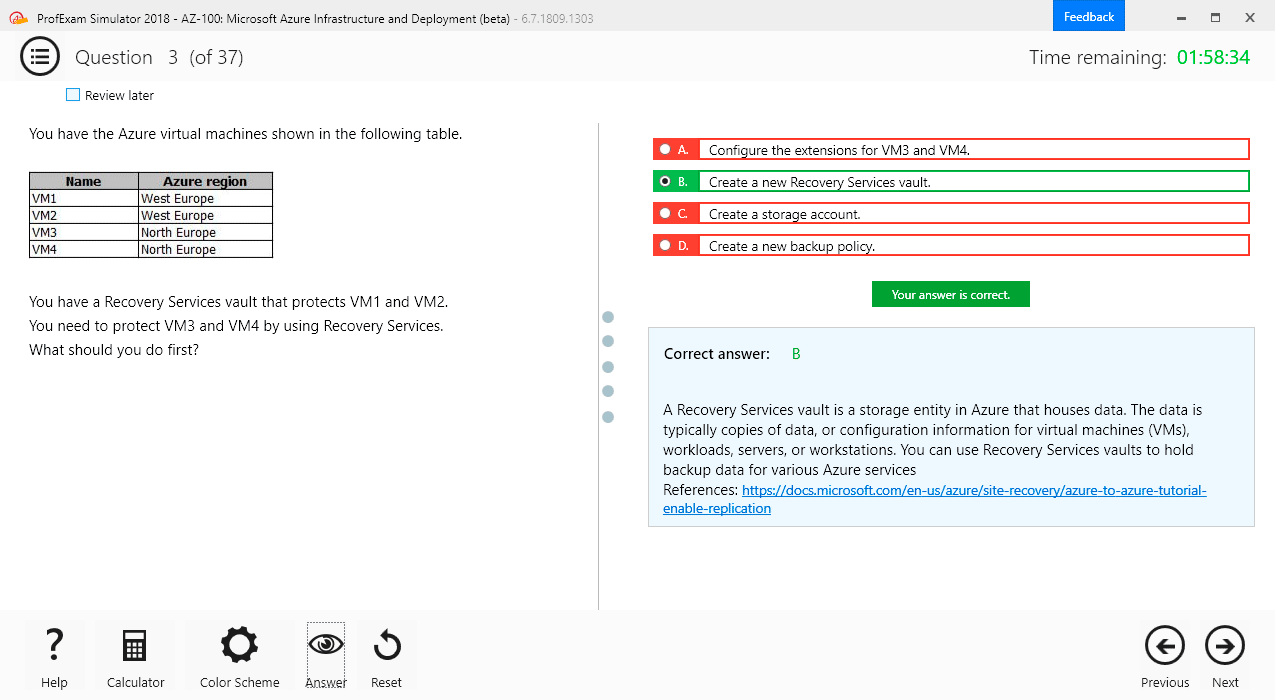

How to open VCEX & EXAM Files?

Files with VCEX & EXAM extensions can be opened by ProfExam Simulator.

Coupon: MASTEREXAM

With discount: 20%

Demo Questions

Question 1

Which of the following market data types can you import into the system?Note: There are 3 correct answers to this question.

- Discount factors

- Forex swap rates

- Security prices

- Credit spreads

- Net present values

Correct answer: ABC

Explanation:

Market data types are used to provide market information for valuing financial transactions and performing market risk analysis. Some of the market data types that can be imported into the system are discount factors, forex swap rates, and security prices. Discount factors are used to calculate present values of cash flows based on interest rates. Forex swap rates are used to calculate forward exchange rates based on spot rates and interest rate differentials. Security prices are used to value securities based on market quotations. Market data types are used to provide market information for valuing financial transactions and performing market risk analysis. Some of the market data types that can be imported into the system are discount factors, forex swap rates, and security prices. Discount factors are used to calculate present values of cash flows based on interest rates. Forex swap rates are used to calculate forward exchange rates based on spot rates and interest rate differentials. Security prices are used to value securities based on market quotations.

Question 2

You work with pre converted currency data for liquidity planning in SAP Analytics Cloud.To which category can this data be applied?

- Forecast

- Budget

- Planning

- Actuals

Correct answer: D

Explanation:

You can apply pre converted currency data to the Actuals category for liquidity planning in SAP Analytics Cloud. This category represents the actual cash flows that have occurred in the past. You can use this data to compare with other categories, such as Forecast, Budget, or Planning, which represent the expected or planned cash flows for the future. You can apply pre converted currency data to the Actuals category for liquidity planning in SAP Analytics Cloud. This category represents the actual cash flows that have occurred in the past. You can use this data to compare with other categories, such as Forecast, Budget, or Planning, which represent the expected or planned cash flows for the future.

Question 3

Your company is performing FX balance sheet hedging.What data is captured with the Take Snapshot Balance Sheet FX Risk SAP Fiori app?Note: There are 2 correct answers to this question.

- Hedge quotas

- Balance sheet exposures

- Market data

- FX hedges

Correct answer: BC

Explanation:

The Take Snapshot Balance Sheet FX Risk SAP Fiori app is used to capture the data for FX balance sheet hedging. The data that is captured with this app includes balance sheet exposures and market data. The balance sheet exposures are the open items that are exposed to foreign currency risk. The market data are the exchange rates that are used to value the exposures and calculate the FX gains or losses. The Take Snapshot Balance Sheet FX Risk SAP Fiori app is used to capture the data for FX balance sheet hedging. The data that is captured with this app includes balance sheet exposures and market data. The balance sheet exposures are the open items that are exposed to foreign currency risk. The market data are the exchange rates that are used to value the exposures and calculate the FX gains or losses.

Question 4

Which of the following must be configured to use Liquidity Planning?Note: There are 2 correct answers to this question.

- SAP Liquidity Planner

- SAP Cloud Connector

- SAP S/4HANA on premise

- SAP Cash Application

Correct answer: BC

Explanation:

To use Liquidity Planning, you need to configure two components: SAP Cloud Connector and SAP S/4HANA on premise. SAP Cloud Connector is a software that connects your on-premise system to SAP Analytics Cloud securely and reliably. SAP S/4HANA on premise is the source system that provides the actual and plan data for liquidity planning. To use Liquidity Planning, you need to configure two components: SAP Cloud Connector and SAP S/4HANA on premise. SAP Cloud Connector is a software that connects your on-premise system to SAP Analytics Cloud securely and reliably. SAP S/4HANA on premise is the source system that provides the actual and plan data for liquidity planning.

Question 5

Which item is part of the standing instructions for the counterparty role for a business partner?

- Trading partner

- Business partner type

- Partner bank

- Business partner relationships

Correct answer: C

Explanation:

The standing instructions for the counterparty role for a business partner include the partner bank item. The partner bank is the bank account of the counterparty that is used for settlement of financial transactions. The standing instructions define the default values and rules for processing financial transactions with a counterparty. The standing instructions for the counterparty role for a business partner include the partner bank item. The partner bank is the bank account of the counterparty that is used for settlement of financial transactions. The standing instructions define the default values and rules for processing financial transactions with a counterparty.

Question 6

When defining payment methods, which setting is made at country level?

- Payment medium format

- Minimum payment amounts

- Account determination

- Payment ranking order

Correct answer: D

Explanation:

When defining payment methods, the payment ranking order is a setting that is made at country level. The payment ranking order determines the priority of payment methods for clearing open items within a country. The payment method with the lowest ranking order number has the highest priority and is selected first. When defining payment methods, the payment ranking order is a setting that is made at country level. The payment ranking order determines the priority of payment methods for clearing open items within a country. The payment method with the lowest ranking order number has the highest priority and is selected first.

Question 7

You are in the process of replacing LIBOR with one of the risk-free rates (RFRs).What are the new interest calculation types with the parallel interest conditions?Note: There are 2 correct answers to this question.

- Lookback interest calculation

- Average compound interest calculation

- Compound interest calculation

- Floating rate calculation

Correct answer: AB

Explanation:

The new interest calculation types with the parallel interest conditions that are used to replace LIBOR with one of the risk-free rates (RFRs) are lookback interest calculation and average compound interest calculation.Lookback interest calculation is a method that uses a fixed number of days as an offset between the interest period and the observation period for the RFRs. Average compound interest calculation is a method that uses a compounded average of the daily RFRs over the observation period to calculate the interest amount. The new interest calculation types with the parallel interest conditions that are used to replace LIBOR with one of the risk-free rates (RFRs) are lookback interest calculation and average compound interest calculation.

Lookback interest calculation is a method that uses a fixed number of days as an offset between the interest period and the observation period for the RFRs. Average compound interest calculation is a method that uses a compounded average of the daily RFRs over the observation period to calculate the interest amount.

Question 8

You are using Credit Risk Analyzer.At what point is the single transaction check executed for a money market trade?Note: There are 2 correct answers to this question.

- When the limit utilization analysis is executed

- When the trade is saved

- When settling the trade

- When the check icon is clicked

Correct answer: BD

Explanation:

The single transaction check is executed for a money market trade at two points when using Credit Risk Analyzer: when the trade is saved and when the check icon is clicked. The single transaction check is a function that checks whether a trade exceeds a predefined limit or not. The check is performed when the trade is saved to prevent unauthorized trades from being entered into the system. The check can also be performed manually by clicking the check icon before saving the trade to see the potential limit utilization. The single transaction check is executed for a money market trade at two points when using Credit Risk Analyzer: when the trade is saved and when the check icon is clicked. The single transaction check is a function that checks whether a trade exceeds a predefined limit or not. The check is performed when the trade is saved to prevent unauthorized trades from being entered into the system. The check can also be performed manually by clicking the check icon before saving the trade to see the potential limit utilization.

Question 9

Which of the following are features of the analysis structure in Market Risk Analyzer? (Choose Two)

- The analysis structure is the basis for market and credit risk reporting.

- The valuation rule is defined on the basis of the analysis structure.

- Multiple analysis structures can be active in a client at the same time.

- An analysis structure is defined as master data.

Correct answer: AD

Explanation:

The features of the analysis structure in Market Risk Analyzer are the analysis structure is the basis for market and credit risk reporting; the valuation rule is defined on the basis of the analysis structure; and multiple analysis structures can be active in a client at the same time. An analysis structure is a parameter that defines how financial transactions and positions are analyzed and valued for market risk purposes in Market Risk Analyzer. Market Risk Analyzer is a submodule of Financial Risk Management that allows you to perform market risk analysis for financial transactions and positions based on various scenarios and key figures. The features of the analysis structure in Market Risk Analyzer are the analysis structure is the basis for market and credit risk reporting, which means that all market risk reports are generated based on an analysis structure; the valuation rule is defined on the basis of the analysis structure, which means that each analysis structure has its own valuation rule that defines how financial transactions and positions are valued; and multiple analysis structures can be active in a client at the same time, which means that you can create different analysis structures for different purposes or scenarios. The features of the analysis structure in Market Risk Analyzer are the analysis structure is the basis for market and credit risk reporting; the valuation rule is defined on the basis of the analysis structure; and multiple analysis structures can be active in a client at the same time. An analysis structure is a parameter that defines how financial transactions and positions are analyzed and valued for market risk purposes in Market Risk Analyzer. Market Risk Analyzer is a submodule of Financial Risk Management that allows you to perform market risk analysis for financial transactions and positions based on various scenarios and key figures. The features of the analysis structure in Market Risk Analyzer are the analysis structure is the basis for market and credit risk reporting, which means that all market risk reports are generated based on an analysis structure; the valuation rule is defined on the basis of the analysis structure, which means that each analysis structure has its own valuation rule that defines how financial transactions and positions are valued; and multiple analysis structures can be active in a client at the same time, which means that you can create different analysis structures for different purposes or scenarios.

Question 10

Your customer requires you to create a two-step approval process. All payment approver groups must receive the workflow approval request at the same time.Which approval sequence will you implement in Bank Account Management?

- Sequential approval pattern

- Non-sequential approval pattern

- Hierarchical approval pattern

- Automatic approval pattern

Correct answer: B

Explanation:

The approval sequence that you will implement in Bank Account Management for creating a two-step approval process where all payment approver groups receive the workflow approval request at the same time is non-sequential approval pattern. Bank Account Management is a function that allows you to create and maintain bank accounts and their attributes in SAP S/4HANA. An approval sequence is a setting that defines the order and conditions for approving a bank account change request by using workflows. A non-sequential approval pattern is a type of approval sequence that allows multiple approver groups to approve a change request simultaneously without any dependency. The approval sequence that you will implement in Bank Account Management for creating a two-step approval process where all payment approver groups receive the workflow approval request at the same time is non-sequential approval pattern. Bank Account Management is a function that allows you to create and maintain bank accounts and their attributes in SAP S/4HANA. An approval sequence is a setting that defines the order and conditions for approving a bank account change request by using workflows. A non-sequential approval pattern is a type of approval sequence that allows multiple approver groups to approve a change request simultaneously without any dependency.