File Info

| Exam | International Financial Reporting Standards for Compensation Professionals |

| Number | T7 |

| File Name | WorldatWork.T7.RealExams.2019-03-11.53q.vcex |

| Size | 26 KB |

| Posted | Mar 11, 2019 |

| Download | WorldatWork.T7.RealExams.2019-03-11.53q.vcex |

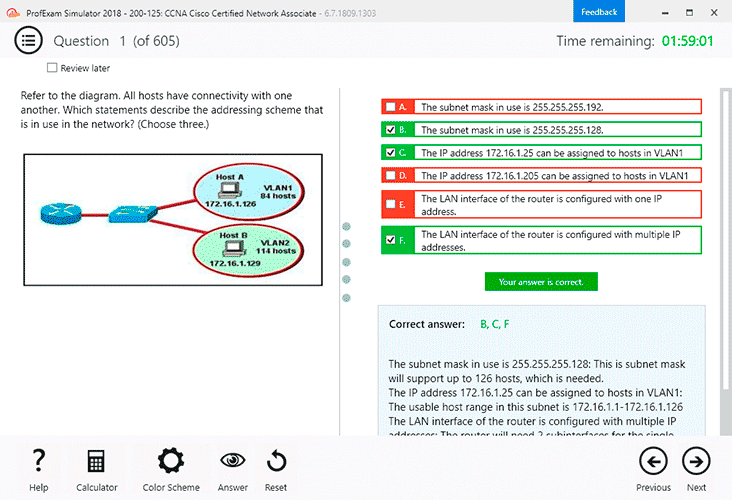

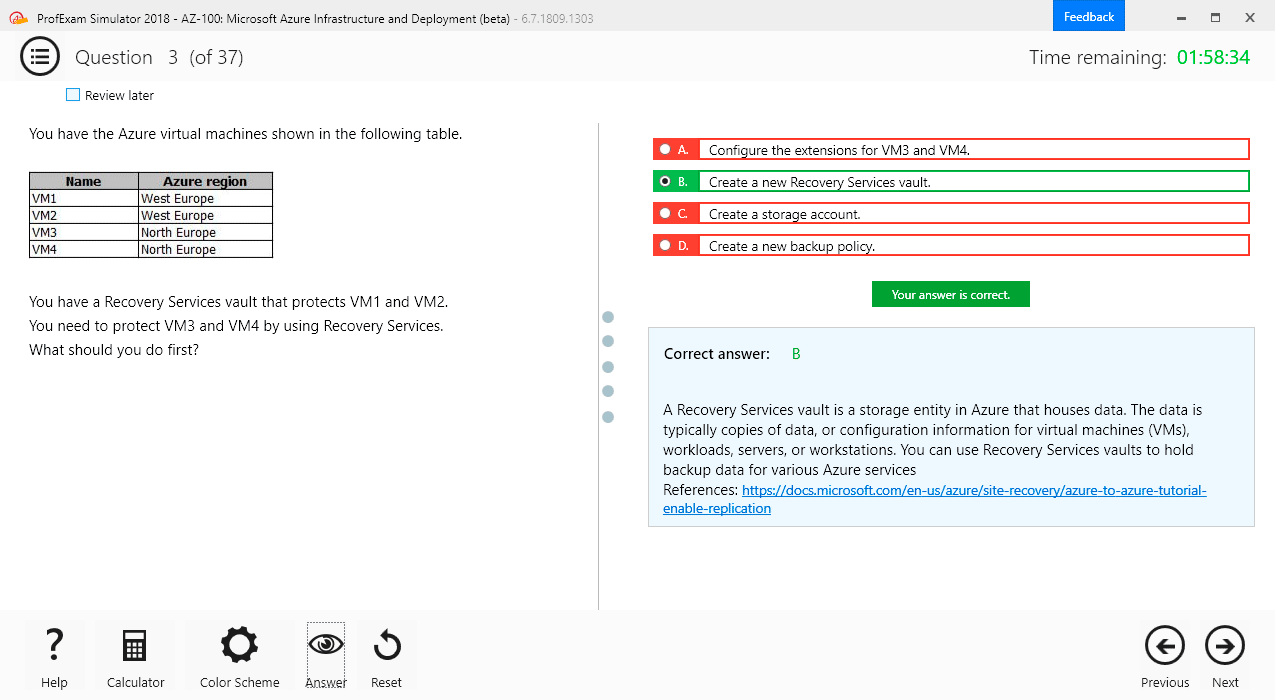

How to open VCEX & EXAM Files?

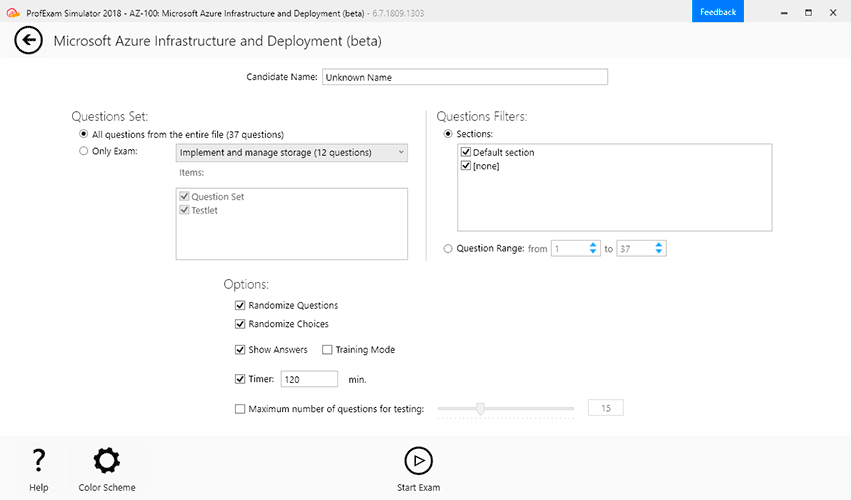

Files with VCEX & EXAM extensions can be opened by ProfExam Simulator.

Coupon: MASTEREXAM

With discount: 20%

Demo Questions

Question 1

Level 2 of the conceptual framework of International Accounting Standards Board (IASB) identifies qualitative characteristics of accounting information. These characteristics distinguish more useful information from less useful information. To what end is this distinction useful?

- For reporting purposes

- For business strategy

- For decision-making purposes

- For organizational vision

Correct answer: C

Question 2

When a company provides information that is of sufficient importance to influence the judgment and decisions of an informed user, which principle of Level 3 of the conceptual framework is being represented?

- Faithful representation

- Measurement

- Full disclosure

- Going concern

Correct answer: C

Question 3

Which fundamental qualitative characteristics make accounting information useful for decision-making?

- Relevance and faithful representation

- Cost and materiality

- Assets and liability

- Income and expenses

Correct answer: A

Question 4

What are the two guiding principles of accrual accounting?

- Expense recognition and matching

- Revenue recognition and matching

- Revenue recognition and measurement

- Cost and materiality

Correct answer: B

Question 5

Which of the following plans obliges an employer to pay a specified amount of benefits to the employee?

- Post-employment plan

- Defined contribution plan

- Defined benefit plan

- Bonus plan

Correct answer: C

Question 6

Which of the following best defines the term “liability”?

- A resource controlled by the entity as a result of past events and from which future economic benefits are expected to flow to the entity

- A present obligation of the entity arising from past events, the settlement of which is expect ed to result in an outflow from the entity of resources embodying economic benefits

- Decreases in economic benefits during the accounting period in the form of outflows or depletions of assets or incurrences of liabilities that result in decreases in equity, other than those relating to distributions to equity participants

- Increases in economic benefits during the accounting period in the form of inflows or enhancements of assets or decreases of liabilities that result in increases in equity, other than those relating to contributions from equity participants

Correct answer: B

Question 7

Which statement below most accurately describes a primary purpose of the Standards Advisory Council (SAC)?

- Informs International Accounting Standards Board (IASB) of implications of proposed standards

- Appoints International Accounting Standards Board (IASB) members

- Approves principles-based standards but does not issue detailed application guidelines

- Has the sole responsibility for setting standards

Correct answer: A

Question 8

Profit-sharing and bonuses are an example of which kind of employee benefits?

- Short-term benefits

- Post-employment benefits

- Termination benefits

- Long-term benefits

Correct answer: D

Question 9

What is the difference between the present value of defined benefit obligation and fair value of plan assets at the end of the reporting period called?

- The financial position

- The deficit or surplus

- The discount

- The present fair value

Correct answer: B

Question 10

Why is accounting for short-term employee benefits generally a straightforward process?

- Because no actuarial assumptions are required to measure the obligation or cost and there is no possibility of any actuarial gain or loss

- Because short-term employee benefit obligations are measured on a discounted basis

- Because short-term employee benefits are not provided in exchange for the service of the employee

- Because the employer is required to incorporate actuarial assumptions into measurement of the obligation and the expenses

Correct answer: A